interview

A new realism dawns in the race for Autonomous Vehicles

Ford and VW have decided to end their shared development of Level 4 Autonomous Vehicle (AV) robotaxis through their joint venture, Argo.ai. Don’t expect major advances anytime soon. LMC Automotive (a GlobalData company) analyst Pete Kelly shares his thoughts.

The Argo.ai entity, in which each company owned a little under 40%, will now be disbanded with the two companies taking on some of the key engineers and developers to work directly for them in autonomous driving and ADAS technologies.

Yagil Tzur

VP of Products

Tactile Mobility

Dave Leggett: I must say, this move was something of a surprise to me; sharing cost in this expensive tech seemed to make some business sense. What’s behind it?

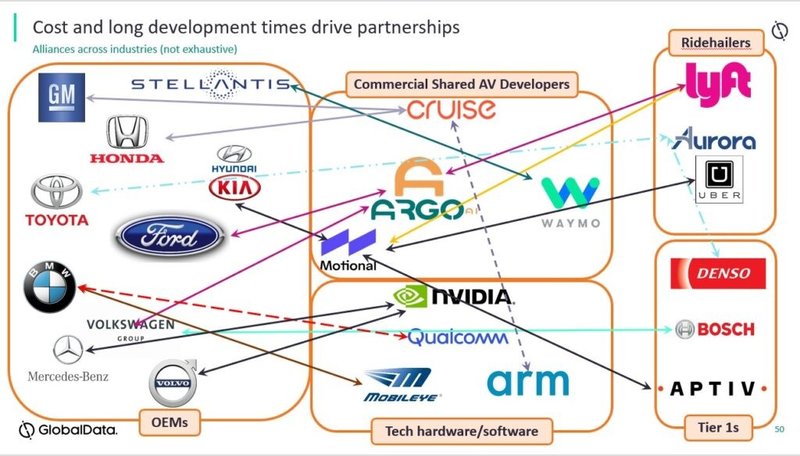

Pete Kelly: I think a few people were surprised that two of the world’s large OEMs [Original Equipment Manufacturer – vehicle manufacturers] are apparently exiting the race to a Level 4 Shared AV [effectively a robotaxi – think Uber without the driver – ed]. Financial pressures and rising costs have undoubtedly played a part. The cost of development in this tech area is extremely high and ongoing at a time when model range electrification is also absorbing company cash.

The lead-time to profitable Shared AV fleets is just too long for these businesses. Getting to Level 4 autonomous driving is a huge technical challenge, but there are also other significant hurdles in regulation, commercial models, (potential) user attitudes, diversity of local complexity, infrastructure and more.

There’s a new realism in the race to AVs. The outbreak of the COVID pandemic in 2020 brought many AV trials to a temporary halt. Since then, AV trials have picked up again but, at the same time, it has become clearer that the road to a world in which Shared AVs (mainly robotaxis and autonomous shuttles) are available at scale is going to be a long and difficult one. And until they are available to travellers at on demand, they will be little more than R&D programmes.

This dawning realization has led to some of the competing players in the race towards Shared AVs to exit on the basis that profitability is many years into the future, while heavy ongoing investment costs are already here. Uber disposed of its AV unit in late 2020 and, more recently, the Argo.ai joint venture between Ford and VW was disbanded. But key players remain – like Waymo, GM’s Cruise, Baidu and others in China – and look set to continue to develop and test AVs in ever more real-world deployments. It’s hard to walk away from large and already sunk R&D investment programmes.

Do you see more consolidation in this area ahead?

Yes. A consolidation in the sector was always likely. For now, the Shared AV landscape in the US is narrowing to just a few players, with GM’s Cruise and Alphabet ’s Waymo appearing more committed and furthest ahead. A number of ventures in China may also start to consolidate around a small number of tech companies, such as Baidu.

For the current set of leaders in the field, pilot programmes continue to be rolled out. If we are going to see further exits, such activity will likely continue right up to the point when it stops. For example, Argo.ai has said that its robotaxis will be available through Lyft in Austin, Texas.

It’s clearly an uncertain pathway and timeline to volume Shared AVs in use isn’t it?

It is likely that we will need to wait until the 2030s before we see the potential for transformative change brought about by truly self-driving vehicles.

At our recent GlobalData “Key Themes in Automotive” event, we discussed some of the difficulties in reaching the point at which large scale deployment of Shared AVs might be possible. It is not so much that there is a lack of belief that Level 4 AV developers will eventually get there – it is more that it could take more than a decade to do it. The several hundred delegates from across the automotive sector seemed to be in broad agreement, with most putting the wider-scale arrival of Shared AV fleets in the 2030s, and 40% suggesting it would be later than 2035.

The two-path approach looks set to continue. On one development path we see companies like Waymo striving to create Level 4 AV vehicles for shared fleet usage; and on the other path, OEMs (and their suppliers) carefully developing ADAS technologies up through the SAE Levels, but aimed at owned vehicles. Some, like GM, have a foot in both camps for now and, ultimately, both routes may be successful. But it is likely that we will need to wait until the 2030s before we see the potential for transformative change brought about by truly self-driving vehicles.

The 2 is Polestar's sole model but the 3, 4, 5 and 6 are on the way

Swamy Kotagiri

CEO, Magna International