Global vehicle market trends down

2019 was a year of declining global vehicle demand. Market declines in major emerging markets - notably China and India - have come alongside largely flat demand in the US, Western Europe and Japan in 2019. All the while, on-going trade tensions between the US and China continue to cast a cloud over prospects for the global economy and dent consumer and business confidence across the world, from Berlin to Seoul.

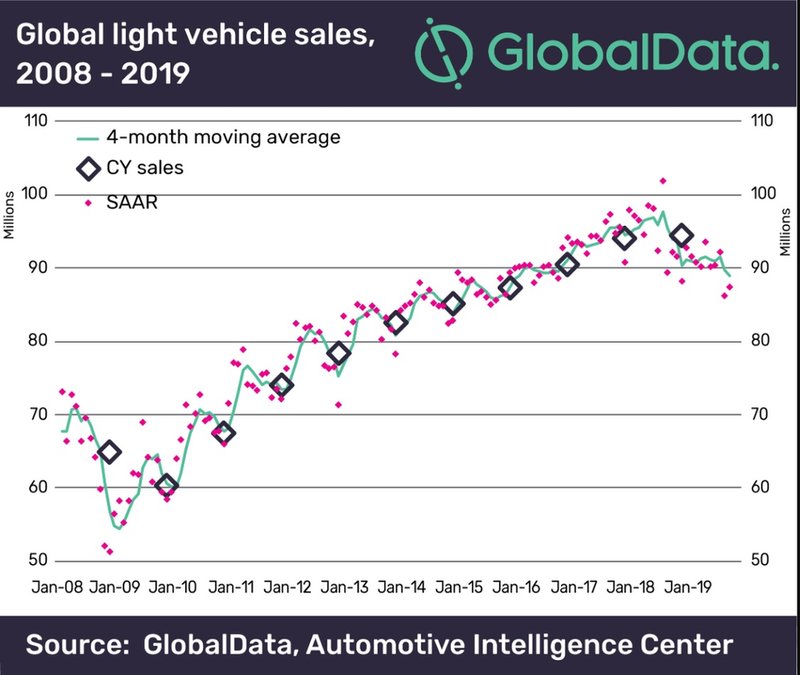

The global vehicle market is likely to turn out 4-5% down for 2019, at around 91m units. Our base case forecast is for a flat or slightly down market in 2020.

At a global level, the auto industry's decline reflects both supply and demand influences. In China, tax incentives finished while in Europe output has been disrupted more than expected as the industry adjusted to new emission standards. In addition, consumers are standing back from the market, concerned over possible technology and emissions regulations changes. We are also seeing a bigger impact from alternative and new urban mobility models - notably carsharing and ride-hail in major population centres across the world. The traditional model of car ownership is far from gone, but it is perhaps fraying at the edges as millennials and others exercise other priorities and opt to consume transport on-demand.

In its latest economic bulletin, the IMF notes that weakness in the global economy is being driven by a sharp deterioration in manufacturing activity and global trade, with higher tariffs and prolonged trade policy uncertainty damaging investment and demand for capital goods. Overall, trade volume growth in the first half of 2019 has fallen to 1%, the weakest level since 2012.

The 2020 vehicle market outlook is heavily dependent on sentiment in the major emerging markets. Prolonged global trade policy uncertainty is damaging investment and sentiment around the world as economies slow and exports stay sluggish. The mature markets – especially the US and Western Europe – will be tending towards flat or declining in 2020 due to unhelpful demand replacement cycle headwinds. Bumper markets in recent years – and a relatively young age profile for the vehicle parc - make delaying replacement purchases easier.

China and India are key. In China, much depends on the path of the economy, the state of demand following market disruption caused by emissions rules changes and expectations of subsidies/incentives applying to electrified vehicles (NEVs). Some forecasters now expect the Chinese automotive market to post modest growth in 2020. Arguably, it could be a similar story in India where this year has seen a number of domestic market negatives conspire to drag the market down. Nevertheless, underlying demand prospects in India are highly positive if the economy can resume higher growth (the IMF forecasts an uptick to 7% GDP growth in 2020), particularly as monetary policy eases.

Other emerging markets that have been depressed this year could also see a degree of rebound next year on the basis of slightly higher global economic growth, less uncertainty over future international trade and also greater stability in financial markets.

US and Europe hit a plateau

- 2020 could see decline for both

Although economic fundamentals in the US remain strong, a decline to the market in 2020 looks likely on the basis of the latest economic and market projections. The US economy shifted to a somewhat slower pace of expansion in 2019 (about 2% pa growth) as the boost from the tax cuts of early 2018 faded.

The US market hit something of a plateau in 2018, continuing into 2019. Light vehicle sales turned out at 17.3m units in 2018, a little less than 1% higher than the previous year. 2019's outturn won't be very much lower and will be close to 17m units again. If it reaches 17m units that will be the fifth successive year the market has breached 17m, so it's running at a natural ceiling, analysts say. The worry is that a big supply of new cars over the past few years could result in a sharp crash if anything negative grabs headlines. Donald Trump's corporate tax cuts have undoubtedly supported the performance of the US economy, but their impact is diminishing. Political turmoil in Washington doesn't help sentiment either and 2020 is Presidential election year. Although economic fundamentals in the US remain strong, a decline to the market in 2020 looks very likely, even as financial conditions improve. There is also the spectre of new tariffs on car imports from the EU and Japan. If they do materialise, higher final prices would further reduce activity.

In Europe, it is also a case of the market being at or close to a natural demand ceiling, with the economic backdrop insufficiently positive to counter hesitant demand. A slower manufacturing sector, reflecting international trading weakness, has hit consumer and business confidence across the region and especially in Germany (the German economy contracted in the second quarter of 2019 as industrial activity slumped). There is little prospect of a major upturn to the European economy in 2020 and major uncertainties persist - notably Brexit. While the UK is likely to leave the EU formally in the first quarter of 2020, negotiations over the permanent relationship between the UK and EU - with trade arrangements at the centre - will continue for much of 2020's 'transition year'. While this ongoing uncertainty acts as a depressing element to economic activity and investment in the UK, there is also a negative impact for the region as a whole.

Europe's light vehicle market is likely to be flat at around 17.6m units in 2019, with a reversal of the order of 3-5% likely in 2020. Key variables are the state of the global economy (trade tensions, interest rates), the business execution of Brexit and any measures (eg scrappage incentives) taken by national governments to stimulate demand and help manage the transition to cleaner, electrified vehicles.

One upbeat part of the region is central and eastern Europe where low rates of motorisation and rising real incomes are helping to lift sales (notably in Romania, Hungary and Poland).

China slowdown

The world's biggest car market went into reverse in 2018 for the first time since 1990. A decline of around 10% New vehicle sales in China fell by 2.8% to 28.1m units in 2018 from a record 28.9m units in the previous year. The trade spat between the US and China has certainly spooked consumers and investors, but China's economy was on course for a slowdown anyway. As Beijing tries to steer the vast Chinese economy towards more domestic consumption and away from reliance on export manufacturing, it's becoming clear that the efficacy of available policy levers is far from straightforward. Worrying levels of overall debt in China's domestic economy will take time to correct. Add in sentiment rocked by new tariffs on US-China trade (with the risk of more to come), declining property prices and stock markets, and it's perhaps no surprise that consumers are sitting on their hands.

A further cause for concern lies in the reversal of demand in the electrified vehicles segment. Since the Chinese government cut subsidies in June, China’s new energy vehicle (NEV) market - comprising mainly electric and plug-in hybrid vehicles - has been in freefall. After growing by almost 59% to 617,000 units in the first half of 2019, NEV sales in the country declined by over 27% to 326,000 units in the four months between July-October.

As far as 2020 is concerned much depends on prospects for the economy and measures that Beijing may introduce to stimulate demand. The central government has already come up with some measures to encourage more NEV sales, including demanding that local authorities eliminate any restrictions on new NEV registrations while also encouraging state-owned enterprises to switch purchases to NEVs.

The main emphasis is clearly on the vehicle manufacturers, both local and foreign joint ventures, to come up with products that will drive the market forward. No doubt, the industry was ill prepared for the minimum NEV quotas the central government announced just a few years earlier, giving them limited time to put long-term strategies into action.

As far as 2020 is concerned much depends on prospects for the economy and measures that Beijing may introduce to stimulate demand.

Significant new capacity is needed to meet the government’s target for NEVs to account for 20% of overall passenger vehicle sales by 2025. In the meantime, those companies that do not meet the rising minimum sales quotas face financial penalties to compensate.

Vehicle manufacturers are beginning to step up their efforts to bring new electric vehicle models to market, however. Volkswagen group this month announced its joint ventures would invest EUR4bn in their local operations next year – 40% of which designated to bringing new electric vehicles to market. The company said it aims to launch 30 new NEV models in the next five years and is targeting 1.5m NEV sales in the country by 2025.

This year GM launched two new electric vehicle models in China, the Buick Velite and the Chevrolet Menlo, as part of a plan to launch 20 new electrified models in the country by 2023. Tesla has just completed an EV plant in Shanghai, with commercial production scheduled to start by the end of 2019.

Leading domestic companies have also stepped up their efforts, including BYD Auto and BAIC Motor, while Volkswagen’s partners FAW and SAIC also have EV programmes of their own. Greater competition and economies of scale will help bring prices down, and improvements in product technology - including faster battery recharging times, should help win over buyers in the next few years.

The year 2020 may be the one in which China's vehicle market and industry gets back on track after a blip in 2019. Confidence is key to getting the vast numbers of customers to consider replacing their vehicles with new models. The world's - as well as China's - carmakers and major component suppliers will be hoping they do.

Larger, curved screens

Jump into a new car today and you are almost sure to find a tablet-style touchscreen infotainment system positioned centre stage of the dash. It acknowledges that most of us no longer use maps to find our way around but expect the car to guide us to our destination and remain connected throughout the journey. For example, the Volvo XC90 comes loaded with semi-autonomous and connected car features, most of which are displayed on an intuitive centre console touchscreen.

As with most new technologies, what starts in the luxury market often trickles down the car segments. Inside the new Honda Civic, positioned at the top of the piano-black finish centre console - and drawing the eye as the push start is pressed - is a Honda Connect 2 seven-inch touchscreen, serving as the main point of contact to control the infotainment and climate control functions. This second-generation of Honda’s infotainment and connectivity system incorporates Apple CarPlay and Android Auto integration.

Tomorrow’s cockpits, according toHarman, will have more curved screens designed using OLED technology. The main advantage of an OLED display is that it works without a backlight, enabling it to blend into the interior.

Screens are becoming larger, too. The Tesla Model S features a huge 17-inch screen. But that is just the tip of the iceberg. China’s Byton has debuted its first concept car. A notable feature of the electric SUV is a colossal 49-inch screen stretching the width of the dash.

Whether or not such high-tech wizardry will actually make it onto the road, the above concepts demonstrate the direction the auto industry is taking.

Voice recognition

While giving instructions in our cars is nothing new, putting questions to the likes of Alexa and Cortana while on the road is. Automakers are fast adopting virtual assistants, confirming that speech is becoming the preferred interface for tomorrow’s cockpit.

Voice recognition is seen by some as the answer to eliminate many controls that have traditionally been manually operated. Voice can play an important part of a multimodal HMI solution for inputting information or for cutting through layers on the menus by requesting a function directly. Traditional voice control was centred on a set of fixed commands with catatonic responses which required some level of driver training prior to operation of the system. With the advent of the new low power, high performance microprocessors, smarter voice command engines linked into the HMI logic are now available. Even natural language and grammatical analysis are becoming more achievable.

Voice recognition, although already an option, looks set to play a bigger role as cars gradually become more autonomous.

If in doubt, ask: Microsoft’s Cortana AI system forms part of BMW’s Connected Car vision.

Gesture recognition

Looking down at a touchscreen (without haptic feedback) can be distracting. Gesture recognition is therefore said to be the Next Big Thing, regarded as the logical next step from touchscreens and buttons. Gesture control operates via a stereo camera within the cabin that can recognise certain hand movements for pre-programmed adjustments and functions. Rotating your finger clockwise at a screen could turn up the volume or a finger gesture could answer or decline a call. While such novelties will make life simpler for the driver, it should also simplify interior design and liberate space for storage options.

Interior lighting trends

Advances have also been made in the interior lighting department. Not so long ago, interior lighting consisted of central and side headliner lights, complemented by low-level ambient lighting located mainly in the cockpit area. Today, the accent has changed, thanks to widespread use of LEDs enabling personalisation of car interiors. For example, during night time driving, the Mercedes-Benz E-Class takes on an entirely different feel thanks to the ambient interior LED lighting that can be personalised using a palette of no fewer than 64 colours. It really does start to feel like a cockpit, adding illuminating highlights to the trim, the central display, the front stowage compartment on the centre console, handle recesses, door pockets, front and rear footwells, overhead control panel and mirror triangle.