DEALS ANALYSIS

Deal activity trends down in most regions; Europe is top region by deals value so far this year

Powered by

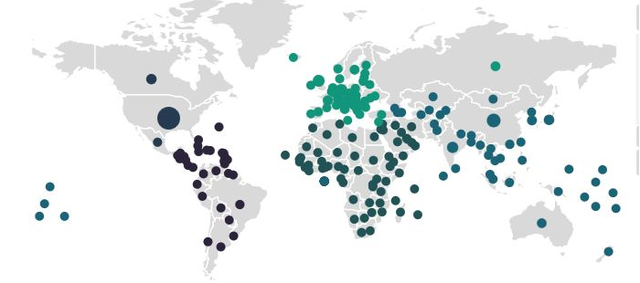

Deals activity by geography

The overall value of technology industry venture financing deals recorded by GlobalData jumped from $119.13bn in January 2019 to $137.93bn in December 2020, representing a 15.03% increase year on year (YoY).

GlobalData’s tracking of completed deals recorded a total of 22,101 transactions across the globe over the two years, with 10,847 and 11,254 deals having been recorded in 2019 and 2020 respectively, representing a 3.75% YoY increase.

North America suffered a 6.62% drop in deal activity over the period following the number of completed deals falling from 9,174 in 2019 to 8,566 deals in 2020. However, GlobalData’s tracking shows that deal activity over the same period grew in the Asia-Pacific, Europe, the Middle East and Africa, and in South and Central America by 24.5%, 13.9%, 11.7% and 3.9% respectively.

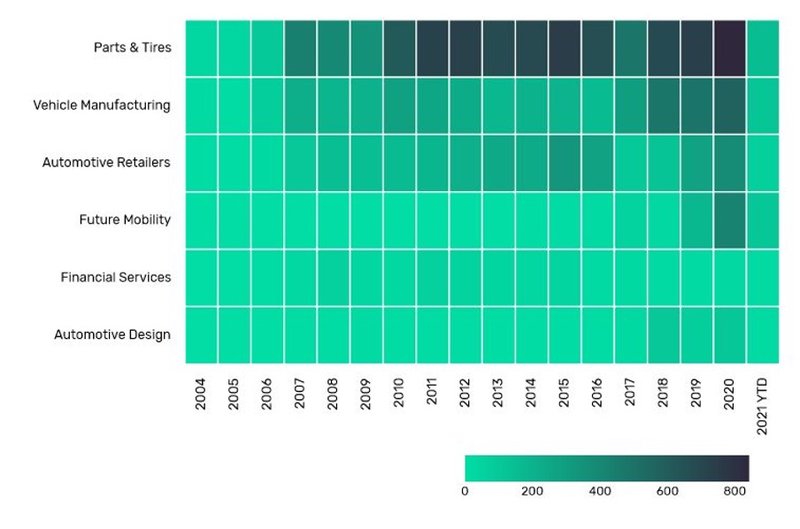

Deals activity by theme

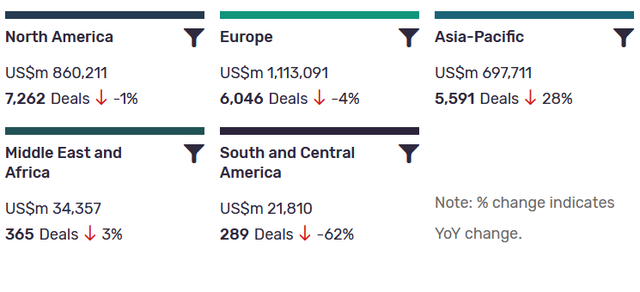

| Deal type | Total deal value ($m) | Total deal count | YOY change (volume) |

| Acquisition | 831006 | 3682 | -74% |

| Partnership | 4319 | 1009 | 71129% |

| Asset transaction | 75028 | 930 | 235% |

| Equity offering | 67470 | 621 | 334% |

| Debt offering | 363602 | 618 | 144% |

| Private equity | 85438 | 580 | -58% |

| Venture financing | 12017 | 538 | 250% |

| Merger | 28159 | 68 | 1918% |

| Deal Type | Total Deal Value | Total Deal Count | YOY Change (Vol%) |

| Acquisition | 1,116,717 | 7,795 | 10 |

| Asset Transaction | 99,102 | 2,409 | 241 |

| Equity Offering | 383,356 | 1,917 | 176 |

| Partnership | 2,208 | 1,841 | 847 |

| Private Equity | 376,208 | 1,731 | 65 |

| Venture Finacing | 68,628 | 1,602 | 198 |

| Debt Offering | 492,965 | 1,070 | 46 |

| Merger | 123,855 | 233 | -88 |

A breakdown of deals by type and value shows that numbers of acquisitions are up versus last year, but by a modest 10% while mergers are heavily down (-88%). Private equity, equity offerings and partnerships are strongly up.

Deals by sector

After a heavy skew towards activity in the supply chain (parts and tyres) in recent years, the start of this year has seen a more equitable distribution across the major automotive sub-sectors.

Note: All numbers as of 19 March 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Automotive Intelligence Center

Latest deals in brief

GM's Cruise acquires Voyage Auto

Cruise LLC, a self-driving car tech specialist majority owned by General Motors, has acquired Voyage Auto Inc, an autonomous technology startup that operates in retirement communities. Both the companies are based in the US. Latham & Watkins LLP represented Cruise in the transaction.

Chengdu Electric Technology secures RMB6 million in funding round

Chengdu Electric Technology Co., Ltd., a China based provider of electric vehicle charging infrastructure, secured RMB6 (USD0.92) million in a funding round led by Wanbang Digital Energy and Xiangji Yang.

Adient exits JV with Yanfeng

Yanfeng Automotive Trim Systems Co., Ltd., a China-based automotive component supplier, has agreed to acquire a 49.99% stake in Yanfeng Adient Seating Co, Ltd (YFAS), a China-based automotive seat supplier, from Adient Plc, an Ireland-based manufacturer of automotive seating for a cash consideration of USD1.5 billion.

Group 1 Automotive acquires Toyota dealerships in US

Group 1 Automotive, Inc., an international, Fortune 500 automotive retailer, has acquired two Toyota dealerships. The dealerships are located in Hyannis and Orleans on Cape Cod. The dealerships are expected to generate approximately USD20 million in annualized revenue. With this acquisition, Group 1's brings its total U.S. Toyota dealership count to fifteen and increases the total representation in New England to ten dealerships, which includes the Audi, BMW, Lexus, Subaru, and Toyota brands.

Sonic Automotive acquires Carbiz Inc

Sonic Automotive, Inc., an automotive retailer, has acquired Carbiz Inc, a company engaged in the car dealership business. Both companies are involved in the transactions are based in the US.