1. Electric car sales are on a charge in 2025 and that continues in 2026

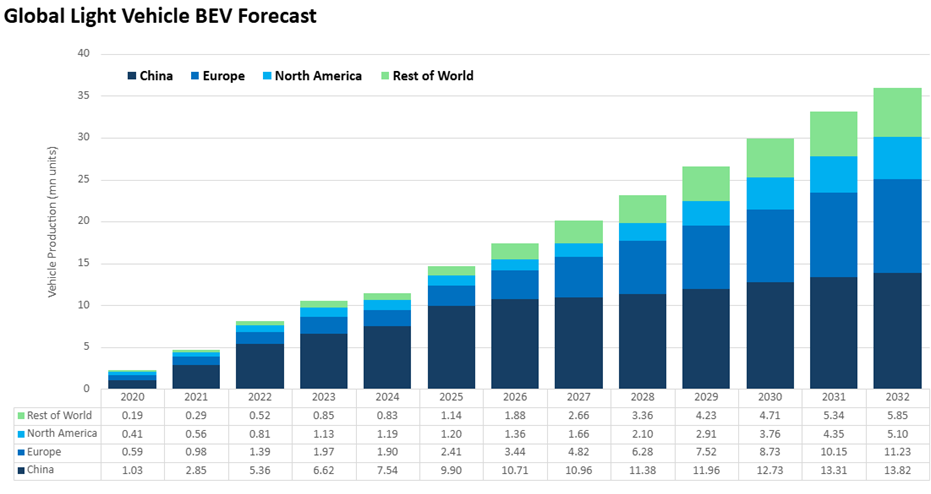

The direction of travel in the world’s auto industry has been set: Battery Electric Vehicles (BEVs) are growing volume and share, led by buoyant sales in China (where public scrappage incentives and a price war have played an important part). Light vehicle BEV sales across the world are forecast at 14.7 million units in 2025, rising to 17.4 million units in 2026. Europe is also seeing rapid growth, but the US has plateaued (see below) after tax incentives for BEVs ended.

Figures include all light wehicles up to 6 tonnes GVW which are registered for persona or commercial use. Credit: GlobalData

2. Automotive supply chains will continue to be high risk and a focus for strategic initiatives at OEMs and supplier companies

2025 saw more supply chain uncertainty when Nexperia – a Chinese-owned company – became a focal point for Europe-China trade/tech tensions. Potential disruption to the supply of vital semiconductors sent shockwaves through the auto industry. The Nexperia chips have multiple controlling applications throughout the vehicle including lighting, airbag and power window systems. The company’s customers tend to be Tier 1 suppliers and OEMs are largely based in Europe and the US, with some also in Asia.

Nexperia’s parent corporation, Wingtech, was placed on a “blacklist” of companies which have been subject to export controls by the US since December 2024. This was extended to include subsidiaries of companies on the list, including Nexperia.

The case highlights ongoing supply chain fragilities in an industry with elongated international supply chains. The interface with national tech security and ongoing trade tensions – especially relevant for tech that overlaps with sensitive applications besides automotive - means that risks are ever-present in the automotive sphere. Expect companies to continue to look to mitigate supply chain risk. It may mean working more closely with other companies, suppliers or technology specialists in the value chain or opting to increase vertical integration with more work carried out in-house.

3. Electric vehicle sales will begin to plateau in North America

Despite early gains, electric vehicle (EV) adoption in the US is slowing down. This can be attributed to dwindling incentives, rising concerns about charging infrastructure, and policy uncertainty. A key factor is the expiration of key federal tax credits, which is expected to have a more immediate and significant dampening effect on demand than concerns over charging infrastructure or policy unpredictability. General Motors has announced plans to cut EV production heading into late 2025 and 2026, citing the expiration of the federal tax credit and its negative impact on demand. Together, these developments suggest that the early-adopter tailwinds are fading, and that without renewed incentives or policy clarity, EV growth in North America may plateau as structural headwinds take hold.

4. The solid-state battery (SSB) arms race continues

The solid-state ‘arms race’ continues, with more suppliers beginning the construction of plants beyond pilot lines and moving to within the scope of ‘Gigafactory’ terminology. However, there are still some uncertainties surrounding the technology’s actual market placement, due to a potentially high price point or inability to exceed existing technology duty cycle capabilities. Nonetheless, samples are being delivered and batch level vehicles are being tested.

Mercedes-Benz, together with US-based solid-state battery provider Factorial Energy, has commenced road tests for a lithium-metal solid-state battery (SSB) in an EQS Sedan.

The project brings together expertise from Mercedes-Benz’s passenger car division and Mercedes AMG High Performance Powertrains (HPP), a British subsidiary specialising in Formula 1 technologies.

5. 2026 will be a pivotal year for global robotaxi adoption

As leading US and Chinese developers push into Europe and the Middle East, 2026 is likely to be a pivotal year for global robotaxi adoption as pilot projects move toward commercial rollouts and companies shift from isolated tests to coordinated international expansion. Although challenges remain, such as profitability and the retraining of AI models, the coordination among technology developers, ride-hailing platforms, automakers, and regulators lowers the barriers to entry.

In 2026, Waymo aims to expand its driverless taxi service to London. Baidu’s Apollo Go will begin tests in Switzerland in December 2025 and aims to launch a public, fully driverless service by early 2027. Chinese autonomous vehicle company Pony.ai is planning trials in Luxembourg, and WeRide will work with Uber to launch services in Saudi Arabia and Abu Dhabi. These moves suggest 2026 will be a turning point for international expansion.

6. Cyberattacks on large enterprises will prompt an industrial rethink

The success of cyberattacks in 2025 on large companies across different sectors, notably retail (Marks & Spencer, Co-op, and Harrods), automotive (Jaguar Land Rover (JLR)), and brewing (Asahi), will embolden hackers to step up their attacks on other major players. Success may well breed success. For enterprises, lessons must be learned. The first is that the cost of cyberattacks is huge. It has been estimated that the attack on JLR had a financial impact of GBP1.9 billion ($2.5 billion) and affected over 5,000 UK organisations. A second lesson is the individual cost to companies like Co-op and JLR of failing to secure cyber insurance protection. The third is that following the cyberattack on JLR, industrial companies, including manufacturers, now know what a devastating cyberattack in their sector looks like. A sector that relied on a tried-and-tested way of working, such as just-in-time delivery, must also consider the risks of that approach. A security shake-up is long overdue.

7. Automotive companies adjust investment strategies on tariffs

Expect the changing dynamics of international trading relations to continue to impact companies’ global investment plans. 2025 saw several big announcements from companies seeking to invest more in US manufacturing, something that is very much on the US Trump administration’s radar when it comes to adjusting levers on trade rules. For example, Toyota has committed to invest an additional $US10m in the US over the next five years, an announcement made at the opening of an EV battery plant in North Carolina. Besides the US, other parts of the world – including Europe and India – will also be centres for new investment plans in 2026 as companies look for ‘natural hedging’ on potential new tariffs and exchange rate movements.

Stellantis grabbed attention when it said it is planning a huge $13bn manufacturing investment programme for the US over the next four years. Stellantis wants to increase annual finished vehicle output in the US by 50% compared to current levels. The company said the outlay is the largest in its 100-year US history.

However, investment decisions – and changes or reversals in new circumstances - can prove controversial though, as was seen by the reaction in Canada when Stellantis said it planned to shift future Jeep production from Canada to a plant in the US.

It’s going to be something to continue to watch as the US embarks on resets to bilateral trade and investment relationships. Other countries are likely to follow that lead, whether they want to or not. The auto industry, with its complex international supply chains and high value products, will always be at the heart of the ongoing discussions and debate.

8. Chinese OEMs continue to expand overseas

China’s auto industry continues to outperform the global auto market, especially in electrified vehicles. The Chinese OEMs, led by the likes of BYD, Chery, GAC and Xpeng, will continue to make progress in markets across the world where they are highly competitive in BEVs and hybrid models. They are targeting Europe, in spite of high EU tariffs, but are also making rapid progress to penetrate markets and localise manufacturing in many other parts of the world.

A representative example: BYD in Brazil has introduced a new powertrain set-up developed specifically for the Brazilian market. BYD’s ‘Super Hybrid’ vehicle comes with biofuel (via processed sugar cane) compatibility. The new version of Super Hybrid was unveiled in October at a ceremony to officially inaugurate BYD’s final-assembly line in Camaçari, Brazil – the factory where the SONG PRO is produced. It will be making an impact in Brazil’s market in 2026.

BYD localises in Brazil. The company confirmed a new investment to expand the factory and double its annual production capacity, from the planned 300,000 vehicles to up to 600,000 units per year. Credit: BYD

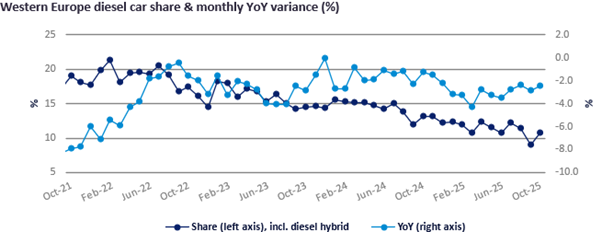

9. Diesel declines in Europe

It is perhaps a long tail of decline, but diesel car sales in Western Europe are continuing a trend decline – they are now around 10% of the overall car market - that will continue in 2026 as buyers move to electrified vehicles. They won’t disappear entirely for a few more years yet. For one thing, they still play a big part in the powertrains of light commercial vehicles (LCVs) and some OEMs will continue to find niche car demand for diesels that they are producing. Diesels remain popular as towing cars (not a strength of BEVs) while also being seen as long-lasting, affordable to maintain and frugal on fuel. Over time there has been a demise of small diesel engines with a greater concentration around the 2.0L displacement area. Diesel cars in Europe: going but not gone.

Source: GlobalData

10. SDVs on the rise

Expect to hear much more about Software-Defined Vehicles (SDVs) in 2026. The evolution of CASE (Connected, Autonomous, Shared, and Electrified) megatrends sparked a global transformation in the automotive industry, initiating a shift toward software-centric vehicles. This evolution laid the groundwork for what is now widely known as the Software-Defined Vehicle (SDV).

Nowadays, software isn’t just an add-on, it’s the driving force shaping the future of global vehicle manufacturing. Advances in Artificial Intelligence (AI), widespread connectivity, and above all, rising consumer demand for smart and seamlessly upgradable vehicles, will all accelerate SDVs in new vehicle product development processes. SDVs treat software as the primary product, enabling features such as over-the-air updates, personalised in-vehicle experiences, and autonomous capabilities. It also involves a rethink on how vehicles are engineered, from the initial concept through post-sale evolution.