DEALS ANALYSIS

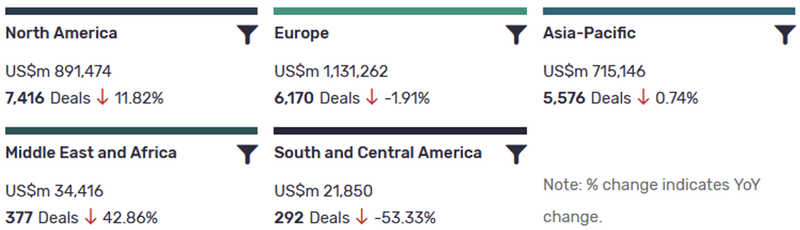

Deal activity trends down in most regions; Europe is top region by deals value so far this year

Powered by

Deals activity by geography

The overall value of technology industry venture financing deals recorded by GlobalData jumped from $119.13bn in January 2019 to $137.93bn in December 2020, representing a 15.03% increase year on year (YoY).

GlobalData’s tracking of completed deals recorded a total of 22,101 transactions across the globe over the two years, with 10,847 and 11,254 deals having been recorded in 2019 and 2020 respectively, representing a 3.75% YoY increase.

North America suffered a 6.62% drop in deal activity over the period following the number of completed deals falling from 9,174 in 2019 to 8,566 deals in 2020. However, GlobalData’s tracking shows that deal activity over the same period grew in the Asia-Pacific, Europe, the Middle East and Africa, and in South and Central America by 24.5%, 13.9%, 11.7% and 3.9% respectively.

Deals activity by theme

| Deal type | Total deal value ($m) | Total deal count | YOY change (volume) |

| Acquisition | 831006 | 3682 | -74% |

| Partnership | 4319 | 1009 | 71129% |

| Asset transaction | 75028 | 930 | 235% |

| Equity offering | 67470 | 621 | 334% |

| Debt offering | 363602 | 618 | 144% |

| Private equity | 85438 | 580 | -58% |

| Venture financing | 12017 | 538 | 250% |

| Merger | 28159 | 68 | 1918% |

| Deal Type | 2020 (US$m) | 2021 (US$m YTD | 2020 volume | 2021 YTD Volume |

| Acquisition | 57,392 | 28,766 | 489 | 267 |

| Asset Transaction | 7,217 | 958 | 186 | 62 |

| Equity Offering | 65,643 | 27,293 | 312 | 104 |

| Partnership | 156 | 842 | 112 | 43 |

| Private Equity | 12,487 | 41,309 | 116 | 51 |

| Venture Finacing | 13,129 | 17,551 | 315 | 174 |

| Debt Offering | 111,229 | 25,283 | 205 | 69 |

| Merger | 2,179 | 13,858 | 40 | 22 |

Deals by sector

After a heavy skew towards activity in the supply chain (parts and tyres) in recent years, the start of this year has seen a more equitable distribution across the major automotive sub-sectors.

Note: All numbers as of 21 June 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Automotive Intelligence Center

Latest deals in brief

Didi Chuxing files for July IPO

China ride-hail giant Didi Chuxing has filed to go public in what could be one of the largest tech initial public offerings (IPO) this year. The Chinese ride-hailing app released its prospectus at the end of last week, setting the company up to raise billions in its US stock exchange debut in July.

Cooper shareholders agree Goodyear merger

Cooper Tire shareholders have overwhelmingly voted to approve the agreement and merger plan with Goodyear, announced earlier this year. At a special meeting of Cooper stockholders, around 99% of votes cast were in favour of the transaction.

Bridgestone invests in Kodiak Robotics

Bridgestone Americas has announced it has made a minority investment in Kodiak Robotics, a leading US-based self-driving trucking company. The partnership will allow Bridgestone to integrate its smart-sensing tire technologies and fleet solutions into Kodiak’s level 4 autonomous trucks.

Nissan sells Daimler stake

Nissan Motor has sold its 1.54% stake in Daimler through a placement to institutional investors, raising around EUR1.15bn. This followed a similar move by its largest shareholder, Renault, which sold a similar-sized stake in the German luxury carmaker earlier this year for EUR1.14bn.

LG Energy acquires stake in Australian ore processor

South Korean electric vehicle (EV) battery manufacturer LG Energy Solution has agreed to acquire a stake in Australian chemicals processing company Queensland Pacific Metals (QPM), to help secure future supplies of input materials.

LG Magna e-Powertrain Company to be established in July

LG Electronics and Canadian auto components manufacturer Magna International are in the final stages of establishing a new electric vehicle (EV) powertrain joint venture.

CATL buys into cobalt mine in D R Congo

Chinese EV battery manufacturer Contemporary Amperex Technology Company Limited (CATL) has signed an agreement with China Molybdenum Company (CMOC) to jointly develop a major cobalt and copper mine in the Democratic Republic of Congo (DRC), the world's largest cobalt-producing country.