The latest update from GlobalData continues to show a positive expectation of global Light Vehicle sales for 2024 versus 2023, though the pace of that growth is now a little slower, at around the 2% mark in YoY terms (down from 2.5%. previous forecast). There have been some positive adjustments made, most notably in China, but overall, the more conservative adjustments to the West European and North America forecasts have outweighed the positives. This is the global market context going into 2025.

In some markets – notably the US - vehicle pricing remains high which is dragging on demand and comes in contrast to the price war being seen in China.

From an economic point of view, the outlook for global GDP growth is marginally higher than three months ago (2.7% versus 2.5%), with global growth for next year also expected to be 2.7%. While there has some concern, including stock market jitters, over the health of the US economy, its slowdown still leaves it on pace for good growth for 2024.

The focus over the coming quarters will be on the speed at which monetary policy easing takes place, both in the US and in the eurozone.

Importantly, for the latter, this should boost activity and see economic growth pick up in 2025 from its current lacklustre position.

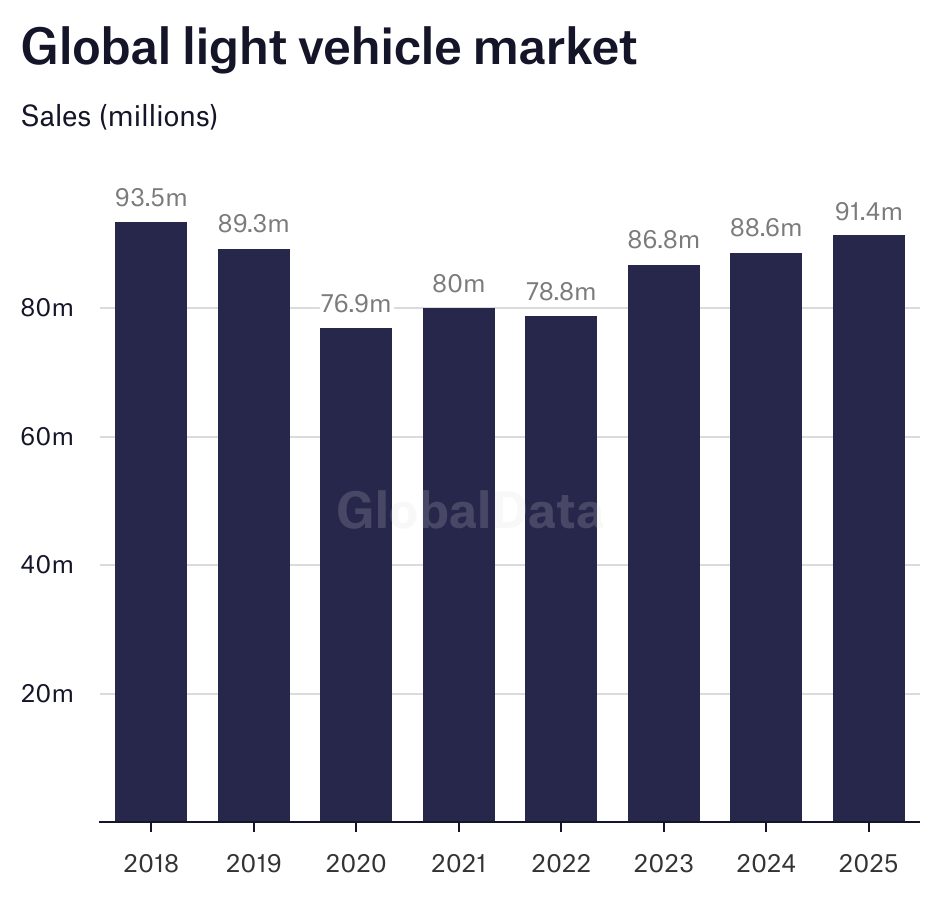

The forecast over the next few years sees global volumes continue to improve, but modestly. GlobalData has taken a cautious view on the expansion of the European market, noting the stickiness in prices impinging on affordability of new cars, in particular.

The last peak for the global light vehicle market saw it hit 94.5 million units in 2017, with a major downturn during the Covid 19 pandemic and supply shortages in semiconductors constraining the sales recovery across the world in subsequent years. In GlobalData’s latest forecast, the market gradually picks up to surpass the last peak in the late 2020s. In 2025, the global light vehicle market is forecast at 91.4 million units, some 3.1% ahead of 2024 (estimated at 88.6 million).

2024-2025 forecasts. Credit: GlobalData

Much remains uncertain as we look ahead to 2025. Political developments in the US may suggest bigger and broader US tariffs elevating downside risks for global trade, investment and wider economic growth.

A slightly stronger than expected close to 2024 in Asia underpins a 550k upgrade to the full-year 2024 LV production projection which now stands at 90.3mn (-0.6% YoY).

For 2025, a demand-led boost in China from confirmed NEV subsidies fails to offset softer assumptions for the demand environment in both Europe as well as North America and GlobalData has cut its global full-year LV production forecast by 290k to 92mn (+1.8% YoY).

Vehicle pricing and the level of required demand management in Europe and North America - but also India and elsewhere - will again be key for volume growth moving through 2025. Although the timing, scale and scope of potential trade obstacles associated with the Trump presidency remain uncertain, downside risks are growing, particularly for the medium term.

Nevertheless, GlobalData expects global LV production to grow in 2025 (+1.8% to 92 million units) following a virtually flat full-year 2024 (0.6% growth to 90.3 million units). The impact from lower interest rates, new model activity and competitive pressure underpins growth in 2025.

Asia-Pacific light vehicle sales

The outlook for the region for 2024 remains positive, with the assumption that since the Chinese government has doubled the amount of temporary scrappage subsidies, market activity will pick up strongly over the course of H2 2024. However, while GlobalData has increased the China LV forecast by 600k, lower expectations in other regional markets have offset much of this China increase.

Looking ahead, sales are expected to continue to surge ahead of the expiry of the scrapping subsidies in December. However, depressed consumer confidence suggests that the positive impact of the incentives will be subdued. Following the announcement of the unprecedented level of monetary stimulus in September, the government unveiled the much-awaited USD 1.4 trillion fiscal package to bail out debt-ridden local governments, but that has so far failed to impress investors and consumers.

Japan’s market is looking weaker still in the latter part of this year, with a combination of a drag on sales from the supply disruption, as well as economic headwinds, squeezing consumer purchasing power. Meanwhile, both near and longer-term expectations for Thailand and Indonesia have been lowered.

In South Korea, the October selling rate exceeded the 1.7 million-unit mark for the first time since November 2023 and reached 1.72 million units/year. Growth was driven by a number of new model launches from smaller players, such as Renault Korea’s Koleos SUV, KG Mobility’s Actyon, and Kia’s new affordable BEV, the EV3. In contrast, Hyundai’s performance was lackluster. Light Commercial Vehicle sales continued to decline by double digits, due to the aging model cycle and high financing rates. In YoY terms, total Light Vehicle sales increased by 3% in October (the first YoY gain since November 2023), but declined by 7% year-to-date.

For 2025, the aggregate forecast remains broadly on-track. Confirmed NEV subsidies in China underpin a boost to Chinese LV output expectations. However, this is broadly offset by slower export assumptions elsewhere with more protectionism providing downside risks.

European light vehicle sales

The European market outlook has been lowered in the last three months, with an average reduction of circa 400k units/year. The forecast cut is centred on Western Europe, though many regional markets have seen the outlook trimmed, with weak selling rates reflecting vehicle pricing remaining at record levels, as well as a mixed economic backdrop.

The recent collapse of both the German and French governments has heightened political uncertainty in the region. Despite support coming from rate cuts and new model introductions in 2025, the combination of political headwinds, high pricing and challenges faced by domestic manufacturers, will continue to challenge market activity in the short term.

Russia’s market, meanwhile, is recovering quickly. However, the Russia-Ukraine conflict only continues to intensify, which is a clear downside risk, not only to the country, but also the regional forecast.

The Western European LV selling rate stood at 13.5 million units/year in October, an improvement on September. YTD sales passed 11 million units, an improvement of 1% from the same period last year. Overall, the outlook for Europe remains unchanged. The current economic and political headwinds have created an unfavourable environment for improving car sales, while pricing remains high. GlobalData expects some improvement in 2025 as monetary policy easing continues as well as the release of less expensive EV models; however, the election of Donald Trump and the potential tariffs present risks to larger economies in Western Europe.

The LV selling rate for Eastern Europe remained relatively unchanged in October at 4.7 million units/year. 430k vehicles were sold, an improvement of 18% YoY. YTD sales remain strong, up 17% from the previous period last year. Despite the rise in recycling fee rates, sales in Russia continued to experience robust growth as importers pre-emptively stockpiled a substantial number of cars, which should suffice for the next month or two. Sales in Turkey continued to fall and follow the trend seen earlier in the year.

GlobalData says growth should uptick in 2025 with the introduction of new models and more monetary easing. However, ongoing geopolitical tensions, as well as the collapse of the German and French government, bring great uncertainty that is expected to drag on sales.

North American light vehicle sales

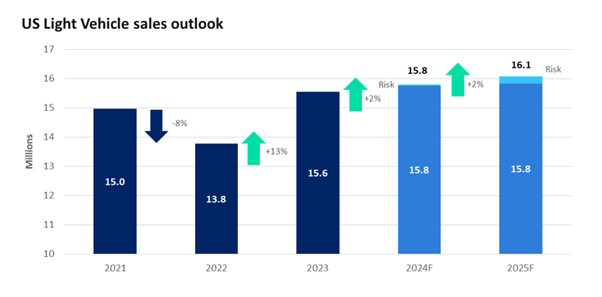

While the US LV market remains in clear growth territory, it faces similar issues as in Europe, namely high vehicle pricing and tight monetary policy. Regarding the former, at least the metric is down from record levels, though affordability remains a challenge. The selling rate has reflected these challenges, having only managed to breach the 16.0 million units/year mark once so far this year (in May). With this slower pace now expected for 2024, GlobalData has trimmed the 2025 outlook accordingly.

Credit: GlobalData Automotive Intelligence Center

US LV Sales have generally disappointed for much of 2024, but there was some uptick in October and November.

Despite some uncertainty over the longer-term outlook for the industry amid potential changes in policy, November sales delivered a strong performance. Volumes were reminiscent of pre-pandemic times, after several years in which the market has been subdued. Even though headlines around Electric Vehicles (EVs) have generally been focused on the negatives, brands with a range of electrified offerings, including hybrids, tended to see an enthusiastic response in November.

However, some consumers in the US could now be moving to take advantage of EV tax credits, given that the incoming Trump administration has signalled that these credits could be scaled back or removed entirely. Credit availability appears to be improving as interest rates on auto loans slowly creep down, but some of that positivity is being tempered by lower trade-in equity for consumers.”

2024 US sales are projected to reach 15.8 million units. Sales volumes for the year are anticipated to increase by 1.5% compared to 2023. The forecast for 2025 has also been revised, with US sales now expected to reach 16.1 million units, reflecting a 2% increase from 2024.

Jeff Schuster, Vice President Research and Analysis, Automotive (GlobalData), said: “As we look ahead to 2025, all attention will be on the initial policy decisions from the Trump administration in January. The potential imposition of tariffs on virtually all vehicles manufactured outside the US could have a notably adverse effect on pricing, leading to reduced volumes both at the overall level and for individual brands with import exposure.

“Approximately 45% of all vehicles sold in the US are imported, with 23% of sales originating from Canada and Mexico. If a 25% tariff were implemented on imported vehicles, US sales could decline by over 1 mn units annually. Given the risks to the automotive sector and the economy, we view this as a negotiating strategy that may not fully materialize. Nonetheless, the prevailing uncertainty is presenting significant challenges to the industry.”

Canadian Light Vehicles sales increased by 15.1% YoY in October, to 159k units, while the selling rate reached 1.98 million units/year, up from 1.93 million units/year in September. Despite a lukewarm economy, the market appears to be benefitting from a slight easing in transaction prices and declining interest rates. In Mexico, sales grew by 12.1% YoY, to 127k units, while the selling rate slowed to 1.45 million units/year, the lowest of the year to date. While this was a disappointing outcome, it would be unwise to read too much into one month’s result in what has been a strong market this year.

South American light vehicle sales

South America’s outlook is little changed from a quarter ago. Modest growth is forecast this year, with this expected to be built upon in 2025.

So far this year, the Brazilian LV market is up by 13.5%, with the severe flooding in the southern state Rio Grande do Sul not having a noticeable impact on sales. Inventory levels have been replenished for a portion of models, allowing automakers to offer their own discounts, without the need for government support. However, interest rates on auto loans remains high, curtailing some market activity.