In October, Chinese automakers commanded attention at the 2024 Paris Motor Show, underscoring a remarkable shift in the global automotive landscape. The event is increasingly becoming a stage for Chinese automakers to showcase their vehicles, highlighting their growing presence and intention to carve out a significant share of the European market amidst a domestic slowdown in China. In doing so, they are positioning themselves as key players in the affordable mobility segment, especially with their early lead on Battery Electric Vehicle (BEV) technology.

Chinese OEM sales growth

The growth of Chinese original equipment manufacturers (OEMs) in the European market has been impressive. Between 2019 and 2023, sales of Chinese vehicles in Europe (excluding Russia and the CIS) have skyrocketed from 17,000 to 360,000 units, representing a compound annual growth rate of over 110%. This expansion shows no signs of slowing down. We anticipate that Chinese vehicle sales in Europe are likely to reach 640,000 units by 2025 and surpass 1 million by 2027-28, bolstered by growing imports and the start of localised production by some carmakers.

As seen by the success of brands like BYD and XPeng at the Paris Motor Show, Chinese automakers are garnering interest with their innovative and niche designs. Indeed, BYD’s focus on cutting-edge BEV technology, coupled with a keen understanding of consumer demand, has allowed it to dominate in China, becoming the bestselling BEV brand in the world’s largest market.

Key Chinese players in Europe

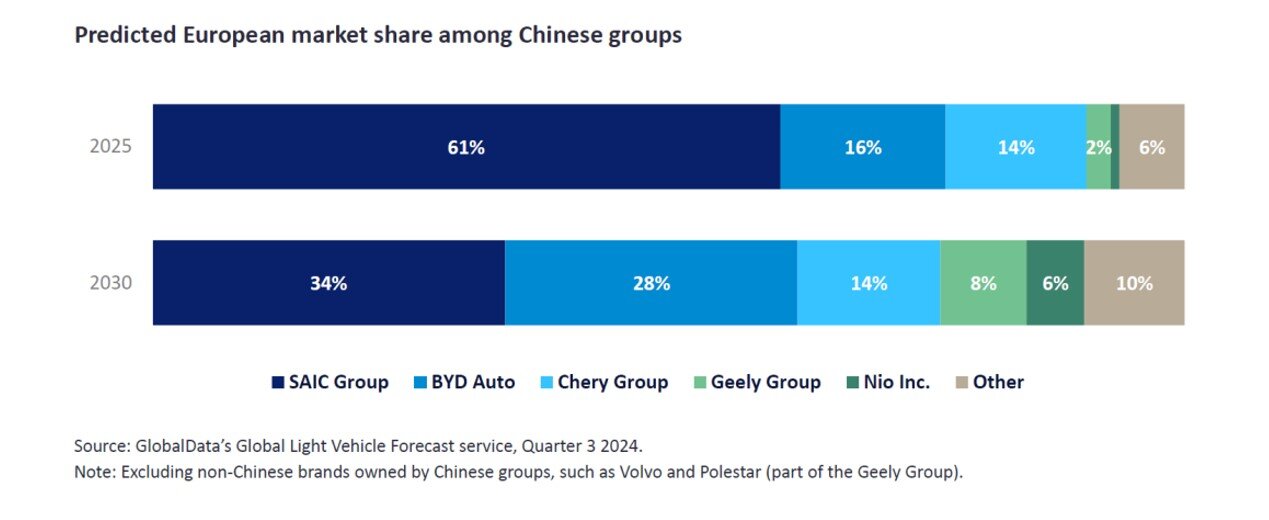

Several Chinese automakers have made significant inroads in the region, with most making their presence strongly felt at the show. Leading the charge into Europe are brands such as Chery, BYD, and MG (owned by SAIC Group). The latter, despite not being present at the event, is set to be the largest Chinese brand in Europe this year with an estimated 280,000 sales. Strong brand recognition – particularly in the UK where MG traces its origin – has helped support the success of both its BEV and ICE-based models.

Chery has also gained significant momentum with its low-cost Omoda 5 SUV contributing to the brand’s expected 14% market share among Chinese groups in Europe next year. At the same time, BYD is set to reach 45,000 sales in 2024, boosted by the popularity of its Yuan Plus and Seal models. Collectively, MG, Chery, and BYD are projected to sell one million cars annually in the region by the end of the decade, as they fully integrate themselves into the local supply chain and begin domestic assembly in the case of Chery and BYD.

Meanwhile, luxury Chinese brands such as XPeng, Hongqi, and Forthing (part of the Dongfeng Group) also came out in force at the show, signalling their desire to take on domestic marques in the premium European market. Though we envisage sales remaining low compared to the large-scale Chinese manufacturers mentioned above, another luxury brand called Nio – also absent at the show – is predicted to become the fifth-largest Chinese group in Europe by 2030.

Caption. Credit:

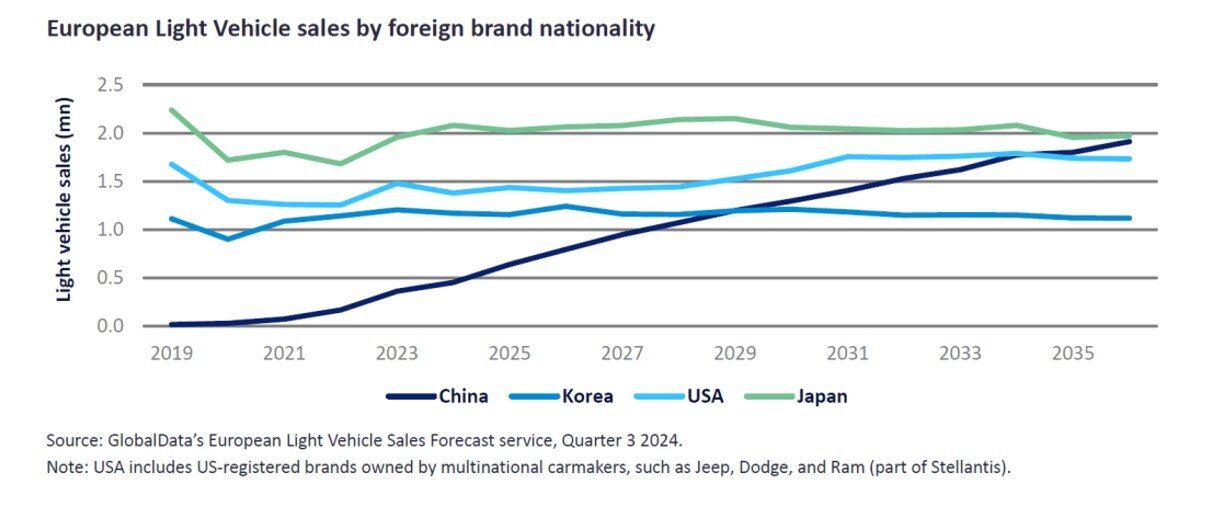

Evolving market share: China to overtake Korea and US

The market share of Chinese brands in Europe has grown rapidly in recent years, rising from a mere 0.1% in 2019 to approximately 3% in 2024. These brands are not only targeting consumers with affordable BEVs but are also strategically positioning themselves to become key players in the European automotive industry, outpacing competitors in core markets by focusing heavily on electrification. However, this growth has sparked concern over the practices driving their success. The EU has recently ratified tariffs on Chinese-built BEV imports after investigating the level of domestic government subsidies received by Chinese automakers. These tariffs, in part, aim to protect Europe’s domestic manufacturers as they embark on their own risky and expensive energy transitions.

Nevertheless, Chinese automotive sales from imported and locally produced models are set to overtake South Korean carmakers in Europe within the next five years and surpass US brands by 2035. Moreover, China is poised to challenge Japan as the largest foreign car manufacturer in Europe in terms of sales by the late 2030s. If Chinese automakers can successfully expand their dealership networks, form strategic partnerships with domestic manufacturers, and begin localised assembly operations, they are projected to capture at least 11% of the European market within the next decade.

This contrasts with the flat or slightly negative sales curves we expect for Japanese, Korean, and domestic OEM brands over the same period, with China likely to capture most of the additive growth in volume as the market expands over the medium term. Indeed, the other Asian carmakers face an example of the Innovator’s Dilemma, with the profitability of hybrid vehicles slowing their adoption of fully electric systems, allowing their Chinese rivals to gain expertise in this key market segment.

Caption. Credit:

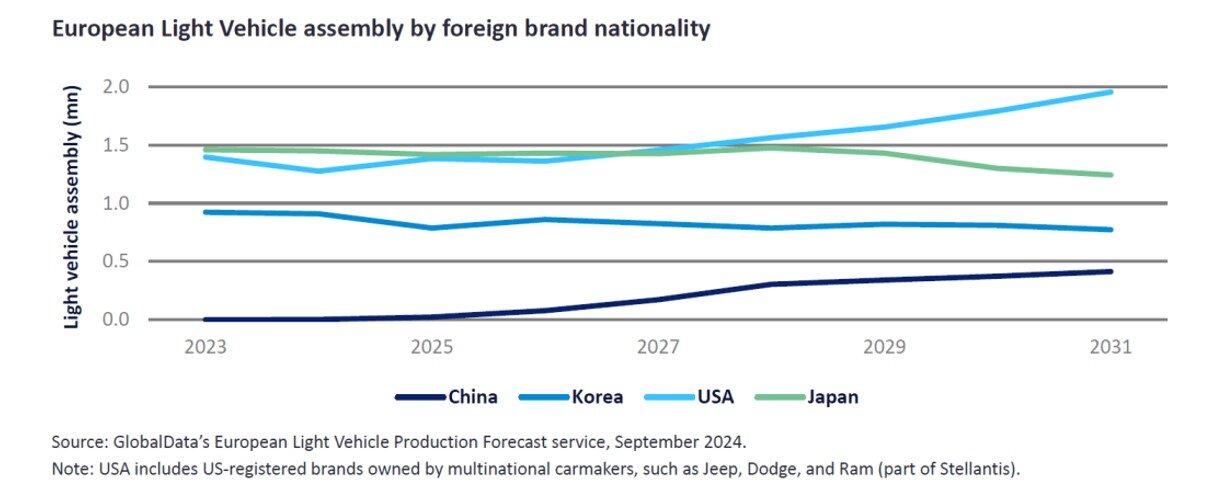

Localised production: Chinese factories in Europe

Chinese automakers are increasingly looking to onshore production in Europe, both to capitalise on the growing demand for BEVs and to mitigate the impact of the EU tariffs. By establishing new car plants or forming partnerships with existing European manufacturers, Chinese companies can take advantage of local supply chains, respond to domestic demand more effectively, and potentially skirt the newly imposed tariffs, provided their vehicles meet minimum local content requirements.

Leapmotor, for instance, became the first Chinese company to localise vehicle production in the EU, after it began semi-knocked-down (SKD) kit assembly at Stellantis’ plant in Poland earlier this year, as part of a joint venture with the multinational carmaker. Chery and BYD have also announced plans to localise production, with Chery acquiring a former Nissan facility in Spain due to reopen in Q4 2025, while BYD is constructing two new car factories in Hungary and Turkey that should be completed in 2026 and 2027. By 2028, we expect Chinese vehicle assembly will reach 300,000 units annually in Europe (excluding Russia and the CIS), representing about 2% of total light vehicle production in the region. It will then converge with the US in terms of European output growth, itself driven by the onshoring of Tesla production to Germany since 2022 and the expansion of its range starting in 2027.

Caption. Credit:

Conclusion

The 2024 Paris Motor Show provided a glimpse into the future of the European car industry, with Chinese automakers poised to play an increasingly prominent role. However, the new EU tariffs on Chinese BEV imports highlight the complex dynamics at play, with significant implications for the scale and pace of their planned expansion in the region. Whether Chinese brands can maintain their current momentum and price competitiveness while navigating these new regulatory challenges remains to be seen. However, their aggressive sales targets and commitment to localised production suggest they will remain a powerful force in reshaping the European automotive sector.