1. European carmakers will launch affordable EVs in 2025

In 2025, European automakers like Citroën, Fiat, and Renault will launch more budget-friendly electric vehicles (EVs)— priced around EUR20,000 ($21,000)— boosting EV demand in Europe following a recent decline in adoption. In comparison, the average price of an EV in Europe in 2023 was EUR46,000 (or $48,400) according to the European Commission.

Look out for Europe/China’s Leapmotor brand in 2025. Leapmotor International is a JV with Stellantis and plans to distribute models (and make) in Europe. Distribution will be through Stellantis’ brands retail networks.

The B10 represents the first of a number of upcoming models that will be launched as part of Leapmotor’s B-series, designed specifically for global markets. It says the new C-SUV is targeted at younger consumers seeking a vehicle that offers not only advanced technology and connectivity but also strong environmental credentials at a competitive price. The T03 is a compact A-segment electric vehicle designed for urban mobility. Starting at GBP15,995, it offers ‘great value for city drivers seeking an affordable, high-quality electric vehicle’.

Leapmotor has already commenced sales in Europe, with over 200 dealers across 13 countries. The company plans to expand this footprint to 500 sales points in Europe by the end of 2025.

2. China will be the first to roll out Level 4 autonomous driving on a commercial scale

In the race for widespread Level 4 autonomous driving, China has a big advantage. China’s provincial governments provide a more relaxed regulatory environment and supportive subsidies to attract autonomous vehicle (AV) industry leaders. By mid-2024, China had chosen 21 cities for an AV pilot program. By contrast, the US had laws regarding AV testing and operation in 20 states but with much stricter regulations and enforcement. Additionally, AVs operating in China’s sprawling cities will provide a more diverse dataset compared to the US's grid-based urban road networks.

While the US leads the world by volume of autonomous driving patents, internal competition between companies like Waymo and Cruise will impede progress, compared to China's national focus on collaboration and technology transfer.

3. Battery technology will enable eVTOL technology ‘take off’

There are high expectations that potential advancements in battery technology will unlock the commercial viability of electric vertical take-off and landing (eVTOL) mobility within the next 12 to 18 months. Unique challenges exist for eVTOL batteries as they require more energy for take-off and landing than during flight. Lithium-ion (Li-ion) batteries, particularly lithium-air batteries—which draw oxygen from the air rather than limited supplies stored in cells—are the top candidate for eVTOLs due to their higher energy capacity. Other options like solid-state, sodium-ion, and fuel cells are being explored. Eventually, solid-state batteries will become the primary choice for eVTOLs due to their high energy density, quick charging, durability, and temperature resistance. Volkswagen-backed QuantumSpace is developing solid-state lithium metal batteries that can charge to 80% capacity in 15 minutes.

4. China will remain the dominant force in the global EV market in 2025

China has built up a considerable lead in the global plug-in vehicle market in sales and production. This is partly thanks to its access to the bulk of the raw materials needed to make EV batteries, enabling it to produce BEVs at a competitive price.

China is also accelerating efforts to ramp up EV sales overseas, particularly in Europe, while domestically, incentives have driven BEV sales up further.

Competition increased significantly in all market segments in the last year, including BEVs, with deep discounting by dealers and ever cheaper models coming onto the market. Margins and earnings are coming under significant pressure, resulting in Chinese manufacturers stepping up their overseas expansion plans.

5. Trade tensions will be high

The return of Donald Trump in the White House will once again raise the possibility of the US adopting a more protectionist stance in international trade. He has threatened to raise import tariffs, not only targeting countries or blocs that have trade surpluses with the US, but also suggesting other justifications for punitive trade measures, including illegal drug flows and immigration to the US. Free trade agreements (such as the USMCA with Canada and Mexico) could be undermined, but much is still unknown or the subject of speculation. In practice, Trump’s administration may have to tread more carefully, mindful of retaliatory measures and the inflationary consequences that could result from new duties on imported consumer goods.

Trade tensions emanating from potential policy changes in the US are not the only concern in the global auto industry. The EU is still in talks with China over tariffs on BEVs.

6. Chinese OEMs will continue to target European market, tariffs or no tariffs

Several Chinese automakers have made significant inroads in the region, with most making their presence strongly felt at the show. Leading the charge into Europe are brands such as Chery, BYD, and MG (owned by SAIC Group). The latter, despite not being present at the event, is set to be the largest Chinese brand in Europe this year with an estimated 280,000 sales. Strong brand recognition – particularly in the UK where MG traces its origin – has helped support the success of both its BEV and ICE-based models.

Chery has also gained significant momentum with its low-cost Omoda 5 SUV contributing to the brand’s expected 14% market share among Chinese groups in Europe in 2025. At the same time, BYD is set to reach 45,000 sales in 2024, boosted by the popularity of its Yuan Plus and Seal models. Collectively, MG, Chery, and BYD are projected to sell one million cars annually in the region by the end of the decade, as they fully integrate themselves into the local supply chain and begin domestic assembly in the case of Chery and BYD.

Meanwhile, luxury Chinese brands such as Nio, Xpeng, Hongqi, and Forthing (part of the Dongfeng Group) have also signalled their desire to take on domestic marques in the premium European market.

7. Look to Japan and Korea for hydrogen applications

The global automotive industry is undergoing a revolution toward zero-emission technology, and in Asia, Japan and South Korea are leading the race for dominance in hydrogen-powered vehicles.

Despite its promise, hydrogen technology faces obstacles like high production costs, limited infrastructure, and energy loss during hydrogen production. Japan and South Korea are working to overcome these barriers through significant investments and government support.

Japan was one of the earliest adopters of hydrogen technology. Toyota, the nation’s leading automotive giant, introduced the Mirai in 2014, making it one of the world’s first mass-produced hydrogen fuel cell vehicles. Toyota has doubled down on its hydrogen vehicle research, investing billions in fuel cell technology for passenger and commercial vehicles.

Toyota plans to begin trials of its newly developed hydrogen-electric hybrid vehicle on public roads in Australia, as part of its multi-faceted approach to developing eco-friendly vehicles. The Japanese automaker has been testing hydrogen-powered vehicles in Australia since last year and confirmed it will begin trials of a hydrogen-electric hybrid version of its Hiace van in early 2025.

South Korea has responded to Japan’s lead in hydrogen technology by accelerating its own hydrogen ambitions, with Hyundai at the forefront. Since launching the Nexo FCEV in 2018, Hyundai has committed billions to establishing itself as a global leader in hydrogen-powered vehicles by 2030, supported by the South Korean government. Hyundai aims to bring a production model based on the INITIUM to market in early 2025, setting new benchmarks in efficiency and performance for hydrogen-powered vehicles.

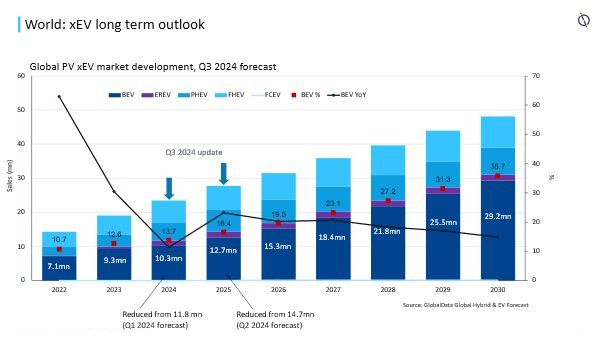

8. BEV sales undershoot earlier forecasts, but there is some optimism

Although global BEV sales continue to grow, the rate of growth slowed considerably in 2024 as consumers pivoted towards other powertrain options – most notably plug-in hybrids (PHEVs), full hybrids (FHEV) and extended range EVs (EREVs). In Europe, BEV share of the new car market has been lower than diesel in some months during 2024 at under 15%.

After a wave of early BEV adoption and sales to businesses, consumers have been put off by high purchase prices, lack of charging infrastructure provision – or associated uncertainties – and expensive fast charging. In the medium-term, analysts say these problems will be addressed. Cheaper BEVs are coming and battery pack prices are falling, while infrastructure provision is improving.

2025, though, is shaping up to be another disappointing year for BEV sales on a global level, with OEMs and suppliers having to grapple with the consequences of lower than previously expected volumes for BEVs. In simple terms, it means the path to comfortable profitability on sales of BEVs is both more problematic and extends further out into the future. That is in spite of sales of BEVs still rising, helped by new and more affordable models coming to market.

On the upside, there will be a cyclical upturn to electric vehicle demand in Germany as BEV leases come up for replacement and more support for business users.

Look out for more national government incentives to stimulate sluggish BEV sales, particularly where the competitive threat to the local industry from imports is perceived to be strong.

Credit: GlobalData 2024

9. Europe’s automakers – and suppliers - will continue to wrestle with overcapacity and restructuring

Worries over manufacturing overcapacity, cost bases and implications for global competitiveness will continue to dog Europe’s auto industry, in particular. Some manufacturers are more exposed than others, but all are anxious to reduce costs in manufacturing or product development wherever possible as they face heightened competition in relatively high-cost BEVs from the Chinese. Volkswagen’s management has stressed the need for labour cost cuts and capacity reductions in Germany, despite ongoing progress in operations and quality. Stellantis, too, faces problems with calibrating electric 500 production at its Mirafiori plant. Cost pressures are also being felt in the supply chain and they will continue to be at the centre of company strategic reviews through 2025 – either in manufacturing footprint adjustments or workforce reductions.

10. GenAI will be increasingly integrated throughout the value chain

Generative AI is being incorporated into vehicles by several large vehicle makers to enhance the customer experience. Generative AI, or GenAI, integrates into voice assistants to provide drivers with more natural, enriching conversations as well as improving overall functionality. Expect this trend to gather pace in 2025.

OEMs such as Volkswagen have incorporated ChatGPT into their voice assistants, giving the vehicles new capabilities such as temperature control, enhanced navigation, or general knowledge. GenAI has also been used on the retail side of the automotive industry. Chatbots and virtual sales assistants allow dealerships to handle customer queries with efficiency and give customers tailored suggestions, up-to-date vehicle knowledge, and even financing.