Cover Story

Fears over a BEV demand slowdown are growing

Fears over the industrial consequences of a slowdown in battery electric vehicle (BEV) demand in Europe and North America have grown this year. Al Bedwell, Director, Global Powertrain, GlobalData and Matt Lucki, Senior Analyst, Americas Powertrain Forecasts, GlobalData write.

Credit:

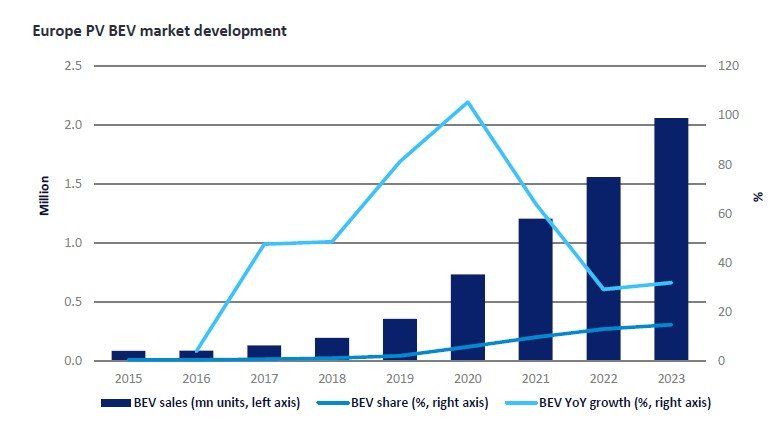

Last year, Europe’s Passenger Vehicle (PV) BEV market grew 32% with positive growth in all months apart from December, which was off a very high base in December 2022. The growth achieved was better than many forecasters indicated at the start of last year (and better than in 2022), with some expecting growth to be flat. BEV sales volume came in at just under 2.1 mn units which is half a million more than were sold in 2022. It is clear there has been some recent slowdown in the market, but it depends where you look. Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023.

Caption. Credit:

Given that charging infrastructure and BEV versus Internal Combustion Engine (ICE)/hybrid prices are still headwinds, it was to be expected that the levels of growth seen from 2019 to 2021 would ease, not least because the buyers to whom BEVs are most attractive (wealthy, multiple-car households with off-road charging facilities) have been somewhat satisfied. In addition, adoption rates for new technologies will tend to rise and fall over time as the use case for them doesn’t grow uniformly but develops in a series of steps leading ultimately to near-100% penetration. Equally, the market over the last few years has been demand-driven whereas prior to that point, fleet CO2 targets were a big factor in the high BEV growth rates seen in the chart above. For some OEMs at least, the medium-term plan for BEV build set in late 2022 or early 2023 was over-ambitious, especially given the economic headwinds faced by many consumers which are only reaching the peak of their influence now due to the lagged impact of rising interest rates, and the car replacement cycle.

What about 2024? Well, we don’t expect people in Europe, on the whole, to be feeling much richer than they did in 2023 although inflation continues to decline for most and it seems interest rates have peaked. Car demand overall is predicted to increase only modestly (+3%) but BEV growth has consistently outperformed car market growth for several years and we expect the same in 2024.

Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023.

Helping this to happen will be downward pressure on average BEV prices. The ingredients are in place for some kind of price war. This won’t be on the brutal scale seen in China where plug-in car prices have, in some cases, been reduced to parity with ICE, but it will help shift BEVs. OEMs have scope to implement targeted downward pricing actions using some of the healthy profits made during the chip crisis. And battery prices are on a downward trend with battery grade lithium and other critical material prices now being seen as on a better trajectory – fears of lithium shortages have receded. We see OEM flexibility in this area offsetting incentive reduction. Many brands have stated that they will compensate for Germany’s BEV grant deletion, for example.

On top of this, 2024 will see the European introduction of several affordable BEV models in the €20k to €25k bracket, bringing in buyers with lower budgets than the traditional average BEV transaction price of €40k upwards. Hyundai’s Casper model is a good example of this. These more affordable cars will be joined by many other BEV models, increasing choice for buyers. So, we remain cautiously optimistic for 2024, though we do expect lower BEV sales growth than seen in 2023.

Will US Battery Electric Vehicle sales stagnate in 2024?

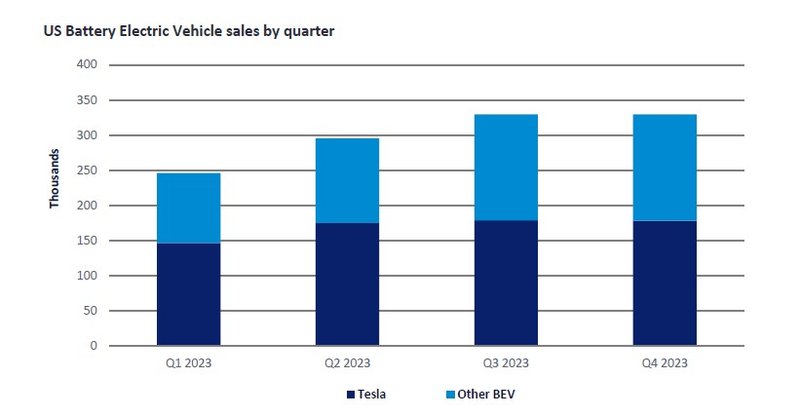

Recapping last year’s Battery Electric Vehicle (BEV) market performance, 2023 BEV Light Vehicle sales exceeded 1.2 million units – the first year to surpass the million-unit mark – and closed with a 7.7% market share. Tesla made up half the volume after setting an aggressive sales growth target supported by multiple price cuts throughout the year. Other automakers also reduced pricing in order to compete and took advantage of IRA federal tax incentives before new battery sourcing stipulations went into effect for 2024. The fourth quarter typically sets BEV sales records each year as dealers sell off prior year models at discounted rates and buyers can quickly benefit from tax credits early in the new year, but Q4 2023 remained flat compared with Q3, signalling a potential softening in the market. While it remains too early to say that the market is trending downward, the sales headwinds are gaining traction. After years of double-digit growth in the US BEV market, pessimism now looms over the industry with the recent sales slowdown, and automotive executives are changing their tune on future growth targets.

Caption. Credit:

Many models lost tax credit eligibility on January 1st, 2024, causing further sales decline as we moved into the new year. With inflationary pressures and vehicle prices remaining high, automakers are under pressure to cut prices further and offer discounts to offset the tax credit loss. The overall auto market condition continues to deteriorate as interest rates remain elevated with relief not expected until the Fed introduces rate cuts towards the middle of the year.

Vehicle pricing will always be at the forefront of the decision-making process when purchasing a new vehicle, but the lack of sufficient US charging infrastructure is the Achilles heel holding back BEV sales for the mainstream audience. Outside of the Tesla Supercharger network, public infrastructure scale and reliability score poorly nationally. Range anxiety is now shifting to charge availability anxiety with many charge points being inoperative and the ones that do work being occupied by other plug-in vehicles. It also now seems to be a yearly occurrence that electric vehicles make the national news when freezing weather negatively impacts range and causes charging stations themselves to fail. In January, Chicago BEV owners were left stranded at public chargers waiting for days while the infrastructure thawed or having to get their vehicles towed to repair facilities. Negative stories around owning a BEV further perpetuate the belief that the technology is market-dependent and specific to a localised use case.

The lack of sufficient US charging infrastructure is the Achilles heel holding back BEV sales for the mainstream audience.

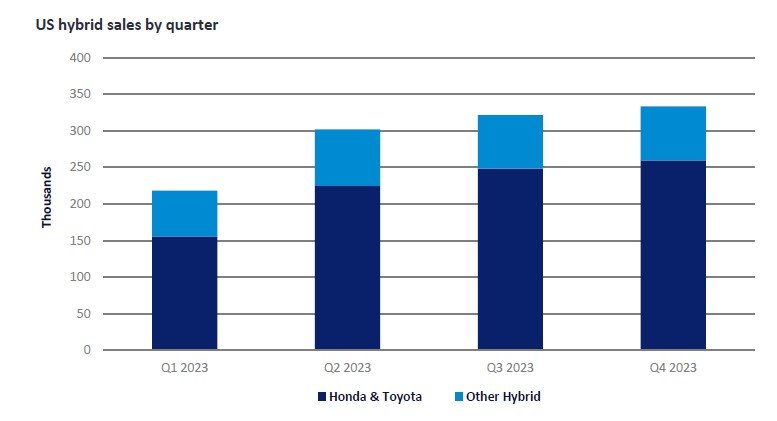

While dedicated electric vehicles face challenging market conditions, hybrid sales are surging. Toyota is standardising the technology on many of its new generation launches and Honda had a successful year launching new CR-V and Accord hybrid variants, applying the technology to its most popular trims. As other automakers see the buyer pool for BEVs dry up, they are now shifting their near-term strategies to push hybrids, using them as a stepping stone until a robust charging infrastructure builds out with federal funding support. We expect the hybrid surge to continue into 2024 and that they will outsell battery electric vehicles by a slim margin of 9.9% to 9.6% respectively.

Vehicle pricing will always be at the forefront of the decision-making process when purchasing a new vehicle, but the lack of sufficient US charging infrastructure is the Achilles heel holding back BEV sales for the mainstream audience. Outside of the Tesla Supercharger network, public infrastructure scale and reliability score poorly nationally. Range anxiety is now shifting to charge availability anxiety with many charge points being inoperative and the ones that do work being occupied by other plug-in vehicles. It also now seems to be a yearly occurrence that electric vehicles make the national news when freezing weather negatively impacts range and causes charging stations themselves to fail. In January, Chicago BEV owners were left stranded at public chargers waiting for days while the infrastructure thawed or having to get their vehicles towed to repair facilities. Negative stories around owning a BEV further perpetuate the belief that the technology is market-dependent and specific to a localised use case.

While dedicated electric vehicles face challenging market conditions, hybrid sales are surging. Toyota is standardising the technology on many of its new generation launches and Honda had a successful year launching new CR-V and Accord hybrid variants, applying the technology to its most popular trims. As other automakers see the buyer pool for BEVs dry up, they are now shifting their near-term strategies to push hybrids, using them as a stepping stone until a robust charging infrastructure builds out with federal funding support. We expect the hybrid surge to continue into 2024 and that they will outsell battery electric vehicles by a slim margin of 9.9% to 9.6% respectively.

Caption. Credit:

As detailed above, there is an inherent risk that the BEV market will stagnate this year and remain close to an 8% share. An upside for consumers will be the likelihood of price cuts offsetting tax credit losses, further discounts on models sitting unsold on dealer lots, and rising lease penetration rates to take advantage of the tax credits. Still, with the market leader Tesla between growth periods, prioritising 4680 cell output and its next-gen low-cost vehicle launch in 2025, the onus to make a statement this year will be on other automakers.

This analysis was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here.