Original equipment manufacturers (OEMs) are far away from net zero. In the auto sector, most OEMs aim to reach net zero by 2050, but emissions reporting and standards remain weak. Incoming regulatory pressure on emissions will require companies to improve their emissions reporting and curate more pragmatic net-zero strategies.

The sector’s main decarbonization strategy is the electrification of vehicle fleets. Yet, most automakers are behind on their electrification target, and electrification is not a one-and-done solution. The production of electric vehicles (EVs) emits more emissions than the production of internal combustion engine (ICE) vehicles.

Automakers must adopt a circular business model and increase the use of sustainable materials. This will help automakers reduce the environmental impact of EV production.

Who is winning the race to net zero?

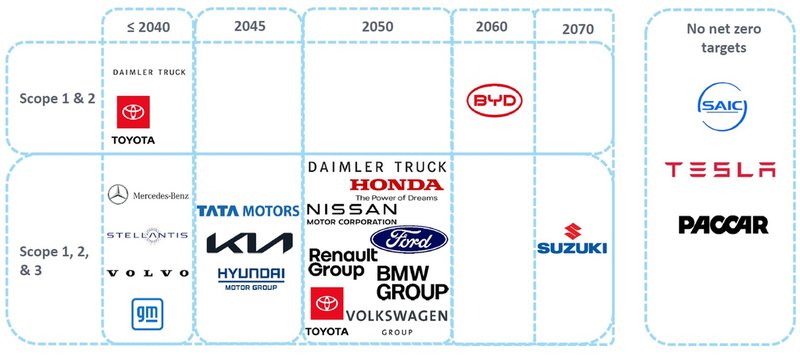

Most automakers have set global net zero targets. Out of the 20 companies analyzed by GlobalData, 15 are aiming to reach net zero across their value chain by 2050.

Caption. Credit:

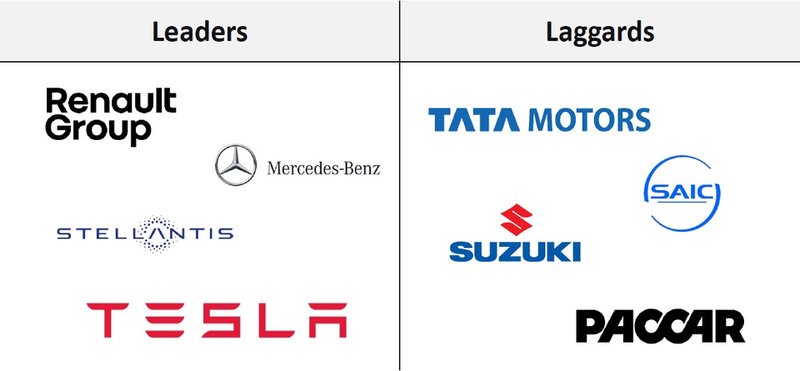

Performance is judged on a company’s emissions reduction targets, the types of decarbonization strategies adopted, its progress in the pursuit of net zero, and the quality of its emissions reporting according to international standards. Below is GlobalData’s assessment of the leading and lagging companies in the auto sector based on the quality of their emissions disclosures as well as the clarity and feasibility of their net zero strategy.

Caption. Credit:

Emissions across auto value chain and the impact on the EU’s 2035 petrol car ban

Although most OEMs have started reducing their Scope 1 and 2 emissions, these reductions are largely insignificant, as Scope 1 and 2 emissions only make up around 1% of total emissions in the automotive sector. In the auto sector, Scope 3 emissions, which the vehicle manufacturer does not directly control, comprise 99% of total value chain emissions.

The use of sold products’ emissions, also called tank-to-wheel emissions, encompass between 70% and 85% of total emissions for OEMs with ICE vehicles as main products.

The most disruptive policy on internal combustion engine (ICE) vehicles is being undertaken in the EU. As part of the ‘Fit for 55’ package, EU institutions have informally agreed to ensure all new cars and vans registered in the EU will be zero-emission by 2035. The proposed legislation bans the sale of traditional ICE vehicles in the EU. An intermediary step towards zero emissions will also require average emissions of new cars to come down by 55% by 2030 and new vans by 50% by 2030.

The proposed EU legislation is driving electrification efforts and net zero targets across the automotive industry and is having a significant impact on Scope 3 emissions reduction targets.

The legislation has forced European automakers to have more ambitious net-zero targets. Stellantis, Mercedes-Benz, and Volvo are all committed to reaching global net zero by 2040, a decade ahead of most global targets. Any automakers in the rest of the world that sell vehicles to the EU market must also adhere to EU regulations.

ICE phase-outs have also been proposed or implemented in the UK, South Korea, California, and elsewhere.

Key strategies for cutting emissions in the auto sector

Transition to renewable energy

Transition of energy consumption towards renewable and low carbon sources is the only viable decarbonization strategy that will allow vehicle manufacturers to achieve Scope 1 and 2 emissions reduction targets. This can be achieved through directly installing renewable energy sources on-site or purchasing electricity from renewable energy providers.

Further helping reduce Scope 1 and 2 emissions, this transition should be accompanied by efforts to improve overall energy efficiency. Switching to renewable energy will also help mitigate some Scope 3 emissions associated with energy consumption of fixed and leased assets and EV charging infrastructure.

EVs are not truly carbon neutral when using electricity from non-renewable sources. Automakers should promote the use of renewable energy throughout their customer base and EV charging infrastructure.

Carbon offsets

Companies purchase carbon offsets to reduce their net emissions when they cannot adequately cut emissions from their own direct activity. In the auto sector, carbon offsets are mostly used to mitigate Scope 1 and 2 emissions.

A carbon offset is a reduction or removal of CO2 or other GHGs to compensate for emissions made elsewhere. Companies purchase them to reduce their net emissions when they cannot adequately cut emissions from direct activity.

Automakers should avoid investing in offsets for now and instead focus on investing in green energy and electrifying their vehicle fleets. Companies could consider establishing their own carbon removal projects that allow them to keep a closer eye on project performance. In the coming years, carbon markets will become increasingly regulated and stringent.

Electrification

Electrification is the main decarbonization strategy for the automotive industry. It is crucial in reducing tank-to-wheel emissions. All OEMs intend to increase their EV and hybrid offerings within the next decade, with many promising to have an all-electrified fleet by 2030. Increased investment in battery plants and EV production plants across the globe is a sign of this transition.

China dominates the global EV market in sales and production, and its market share will continue to rise. This is partly thanks to its access to the raw materials needed to make EV batteries and long-term government investment in growing the subsector.

Regulation in the EU will force OEMs in Europe to fully electrify their fleets by 2035, while the global market will be slower to transition.

To reach net zero targets, OEMs should prioritize increasing BEV production and sales over other LEVs. However, improvements in BEV production capacity are necessary if automakers intend to reach electrification targets and there is some concern over market demand for EVs. In October 2023, Ford and GM pushed back their electrification targets and spending on EVs due to lower-than-forecast demand.

Hydrogen fuel cells

Hydrogen fuel cell electric vehicles (FCEVs) are an alternative form of low-emission vehicles to HEVs and BEVs. FCEVs are still far behind BEVs both in terms of development and demand.

The electricity is produced onboard the vehicle. In contrast, BEVs use a battery to store electric power from an external source. The tank of an FCEV is filled with pure hydrogen. Along with oxygen, the hydrogen is fed into a fuel cell that then converts the hydrogen’s chemical energy into the mechanical energy needed to drive the vehicle. The only waste product produced during the cell reaction is water.

Heavy-duty and commercial vehicles will be the first mainstream applications for hydrogen fuel cells. Research and investment into green hydrogen produced using renewable energy is steadily increasing. The problem of hydrogen fueling station infrastructure is also lessened, as heavy-duty commercial vehicles tend to run along more defined routes with little deviation. Toyota, for instance, expects to sell 100,000 units of FCEVs by 2030, mostly from commercial vehicle sales.

Alternative fuels

Biofuels are primarily used as a replacement for current fossil fuels. Their use is primarily driven by government policy to promote emissions reduction. According to GlobalData, annual ethanol and biofuel use will increase to 253 billion liters annually by 2030, up from 191 billion liters in 2023.

The main low-carbon fuels used in road transportation are ethanol and biodiesel. Ethanol is used as a replacement for gasoline, while biodiesel is used as a replacement for fossil diesel. Blending rates vary widely between countries. However, the average global blend of ethanol in gasoline is around 7%, and biodiesel in diesel is 5%.

Synthetic fuel technology is still in its early stages, and its production remains low compared to other low-carbon fuels. In April 2022, Porsche invested $75 million in the production of synthetic fuels.

In the auto sector, low-carbon fuels are a useful tool in the phase-out of ICE vehicles but should not be adopted as the primary decarbonization strategy by vehicle manufacturers.

Circular economy

Adopting the circular economy is key for automakers to reach net zero. To reduce GHG emissions associated with the manufacturing of passenger and commercial vehicles, automotive companies must replace the traditional linear take, make, use, and dispose path and adopt more sustainable materials and technologies.

According to Tesla, manufacturing a single EV emits 10 mtCO2e more emissions than manufacturing an ICE vehicle, with battery production being responsible for between 40% and 60% of EV manufacturing emissions.

It is critical that OEMs work closely with suppliers to reduce emissions associated with the production, manufacturing, and recycling of vehicles. The circular economy is a fundamentally different approach to how products are designed, produced, and used. It aims to minimize waste across the vehicle lifecycle, from production to end-of-life disposal.

The batteries market is the biggest obstacle to achieving a circular economy in the auto sector. Currently, EV battery manufacturing is a high-emissions process, and batteries only last around 10 years.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis;used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.