Cover Story

Is there a downturn coming for the auto industry?

Editor David Leggett considers the big picture ahead for the auto industry in 2024.

Credit:

Is there a downturn coming for the auto industry? The answer is probably no, but it may well feel like one.

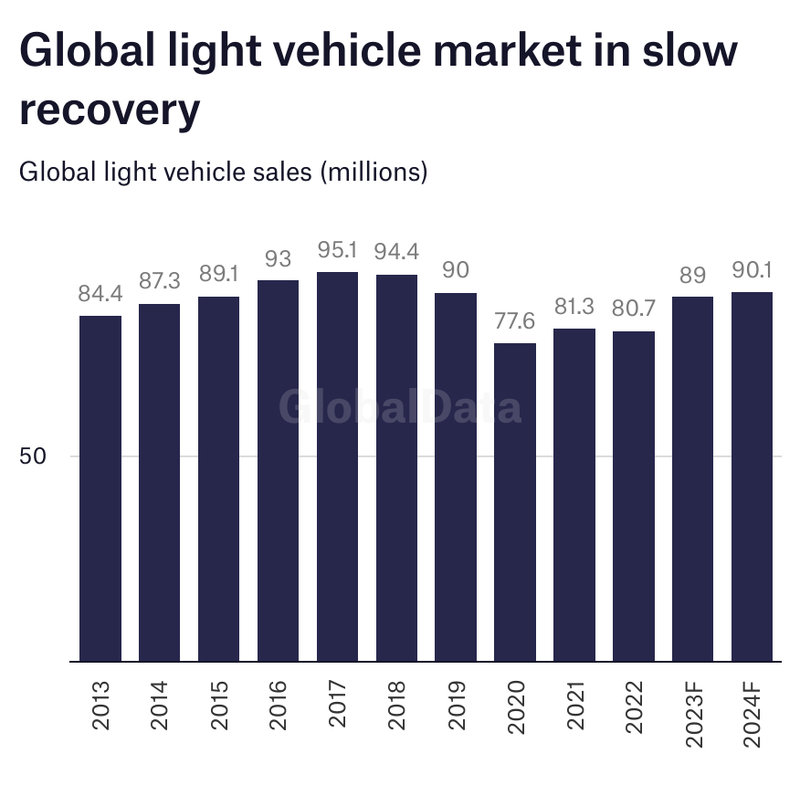

The global light vehicle market is forecast by GlobalData at a little under 90 million units this year, with a similar level in prospect for next year. Yes, the market has bounced back in 2023 (up 10% on 2022) as supply shortages eased and manufacturers were better able to meet customer demand and address order backlogs and start to reduce inventories. For context, that 90 million unit global market level is where we were in pre-pandemic 2019, but the last peak was actually 95 million in 2017. Overall then, the market slows after the rebound to be – well, flat.

Flat isn’t a downturn, but the risks look to be piled up on the downside, at least as far as the global economy and major markets are concerned. Crucially, it may feel like market conditions have worsened, especially after 2023’s volume rebound boosted profits. There is already talk of incentives starting to be rolled out in the US. It doesn’t take much to get that button pressed again.

Nevertheless, the US light vehicle market was up 8.5% in November. China’s vehicle market has been pretty resilient, but there are worries over the stability of and outlook for its economy.

Generally, there’s a feeling that still high price inflation means interest rates will stay higher for longer, putting household and business budgets under pressure. Meanwhile, public debt across the world is high and the cost of servicing that debt has risen sharply over the past two years. Therefore, public spending levers for growth likely won’t be working overtime over the next two years. On top of that, there are geo-political crises for the world that show little sign of resolution. That adds potential for knock-on economic impact volatility.

GlobalData has just adjusted its Western Europe car forecast for 2024 downward on the basis of a deteriorating economic outlook for the region. Enjoy the year-on-year market gains while you can.

A global market at around 2019 levels is perhaps the best we can hope for in the current circumstances. But as major OEMs and major system suppliers contemplate a flat global pie while also managing persistent cost pressures, reshaping their supply chains for costly EVs and maintaining investment momentum in costly advanced technologies – it may well feel like headwinds have strengthened in 2024.

Caption. Credit:

Top trends to keep an eye on in 2024

- Profit margins under pressure. While the auto industry has enjoyed strong profits in recent quarters, the outlook is for softening demand. Meanwhile, cost pressures and supply chain uncertainties remain an issue.

- China’s exports continue to grow. At the moment, sales penetration of Chinese brands is still at a pretty low level in Europe - around 2-3%, but it has been growing rapidly. And all this is raising fears that Europe is in danger of being overwhelmed by cheap – and probably more importantly – good Chinese BEV imports. Keep an ear out for the EU Commission’s investigation into unfair Chinese subsidies. It could be politically very sensitive indeed if the EU moves towards imposing higher tariffs on Chinese imports to the bloc. As China’s domestic economy comes under more pressure, OEMs will aggressively look for more export growth – especially with EVs and hybrids.

- BEV growth is slowing, pivoting away from China. Globally, BEV share reached 13% of car sales by the end of October, compared to 10.6% for full-year 2022. To October 2022 BEV growth was about 80% while the total market shrank by 1%. This year global BEV growth is 41% and total market growth is 10%. So, BEV continues to outperform the market, but not as dramatically as it did a year ago. BEV growth has fallen from 100% in 2021 to 70% last year and 40% this year. Removal of the NEV subsidy ended China’s low-cost electric car boom and regulation has pushed OEMs towards better tech and away from huge volumes of cheap cars supported by subsidies. BEV affordability remains good in China, but less so in mature markets and that is a headwind for growth. Keep an eye on Tesla vs BYD, the two EV giants vying for global market leadership. BYD is targeting Europe in 2024, but market geography geared to China’s domestic market could hold it back.

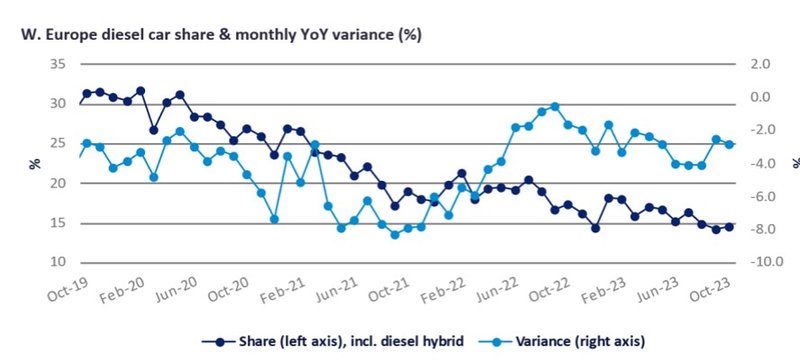

- Diesel is increasingly marginalised. Once feted as Europe’s green fuel, diesel is increasingly being confined to the commercial vehicle sector and as CO2 reduction targets expand from the car sector to LCVs, it will fall further. Petrol-electric hybrids are taking up the diesel slack from those who are not ready to go full BEV or have concerns about range due to their patterns of use. Diesel share of the West European car market is now down to around 15%.

Caption. Credit:

- More AI applications. All along the automotive value chain, we can expect to hear more about Artificial Intelligence and how it can improve operations, lower costs and enhance consumer experiences. Whether it’s the ability for factories to better optimise output in response to more accurate sales forecasts or AI-based inspection systems for workshops, AI applications and their impact are expected to increase.

- M&A dynamics stay lively. As the auto industry continues to face big structural challenges wrought by the progress of advanced technologies, the corporate landscape will continue to adjust. Supply chains will continue to change as companies seek to rebalance operations, divest non-core activities and look for acquisition opportunities – especially in tech areas perceived as high-growth and complementary. Also, start-ups will continue to thrive – but also crash. Those start-ups that involve heavy initial investment will continue to be potentially vulnerable to any cash-flow disruptions. That does, however, create an opportunity for investment companies to manage assets with perceived future value before passing them on again. It’s going to be a dynamic playing field for M&A.

- China’s market slows. Strong recent performance of the Chinese domestic market has been supported by new government economic stimulus measures and vehicle price cuts boosting affordability (particularly EVs). Worries over China’s domestic economy persist. Not only has the property sector gone into sharp reverse, but economists are also worried about political and trade tensions between China and the US.

- Supply chains in focus. After the supply chain disruption of recent years, automotive companies are trying – with varying degrees of success, to learn lessons (especially on getting better supply chain transparency) and mitigate future risk. However, an even bigger challenge arises from the energy transition. Electric vehicles need different parts to ICE vehicles and this will necessitate a rethink on who supplies what. Many Tier 1 suppliers are well advanced in reconfiguring operations for electrification, but there is a long way to go. Supply chains face big structural changes ahead, starting with capacity for batteries. It’s not just gigafactories though – there are a lot of other components that will need to be supplied in bigger volume, as well as some ICE-related parts that will be going in the opposite direction.

- Fully autonomous drive may have stalled. More automated driving definitely has a ring of long-term inevitability about it, but the fully autonomous vehicle is still some way away from market reality. The travails of GM’s Cruise unit were something of a wake-up call in 2023 and vehicle manufacturers have certainly had other priorities for investment programmes in recent years – notably the need to get more and better EVs through costly design and development phases to market. That said, advanced driver assistance systems (ADAS) are getting more numerous and better. We can expect to see more manufacturers offering Level 2+ and 3 capable automated drive through 2024 and 2025. It may be high-end to start, but expect the technology to trickle down rapidly to more models once a brand installs the tech. That is, of course, assuming that market acceptance and enthusiasm for such features is there.