Comment

The polarisation of China’s automobile production capacity

Despite 2023 being - overall - a good year for China's automobile market, overcapacity is becoming hard to ignore. Production Analyst, Nan Zhang writes.

Credit:

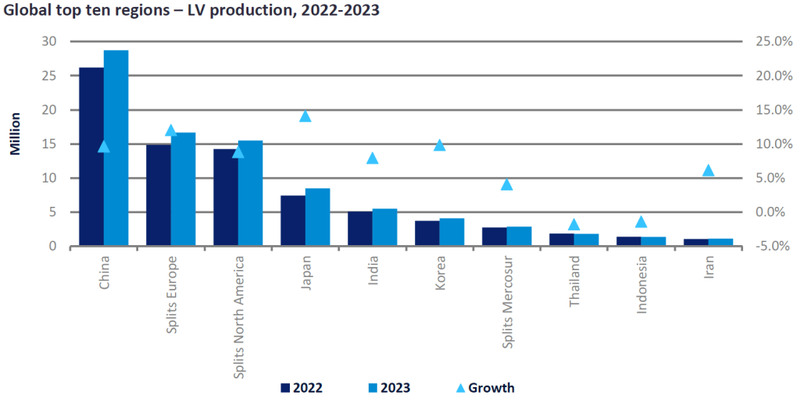

Due to the ongoing vigorous price war, 2023 will turn out to be an exciting and high-profile year for China’s automobile industry. From leading brands to niche brands, from new energy vehicles (NEVs) to internal combustion engine (ICE) vehicles, fierce competition has occurred throughout the year. China’s light vehicle (LV) production total has ranked first in the world for fourteen consecutive years and is expected to account for 32% of the global total in 2023. NEV production and sales have ranked first worldwide for eight consecutive years. As can be seen from the chart below showing the top ten LV production areas in the world, China’s production has reached 1.7 times that of Europe, in second place.

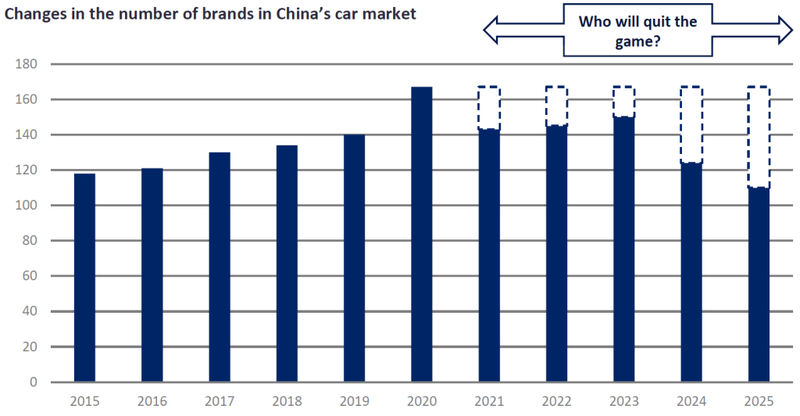

According to official vehicle data, there are currently about 150 active brands in the Chinese automobile market. Among them are 97 Chinese domestic brands and 43 joint venture (JV) brands. In May 2023 Zhu Huarong, chairman of Changan Automobile, said: “In the next 2-3 years, it is conservatively estimated that 60%-70% of brands will face closure and transfer.” This means that these “shut down and switch” ICE vehicle brands will create many idle production lines. No matter how big the Chinese auto market is, it cannot accommodate hundreds of brands. Both local Chinese brands and JV car companies are facing the impact of structural market changes. OEMs without brand value, core technology and development capital will fail one after another. The traditional automobile market has now entered the stage of consolidation. According to local statistics, some brands have been forced to withdraw from the Chinese car market in recent years. These include Zotye, Lifan, Borgward, WM, AIWAYS, Mitsubishi, Renault, Acura, and others. All of these have been obliged to exit the stage because of intense competition.

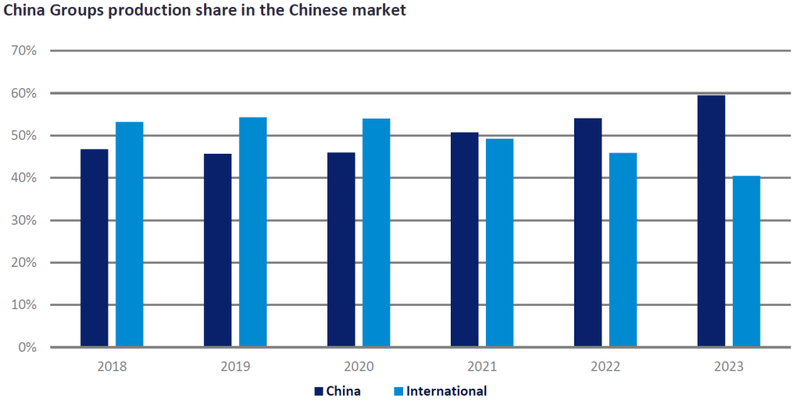

Against the background of the rapid growth of NEVs in China, as of October 2023, the output of Chinese brands has increased by 20% year-on-year, while the output of JV brands has decreased by 8% year-on-year. According to China’s production data over the years, the proportion of Chinese brand production increased from 47% in 2018 to 60% this year.

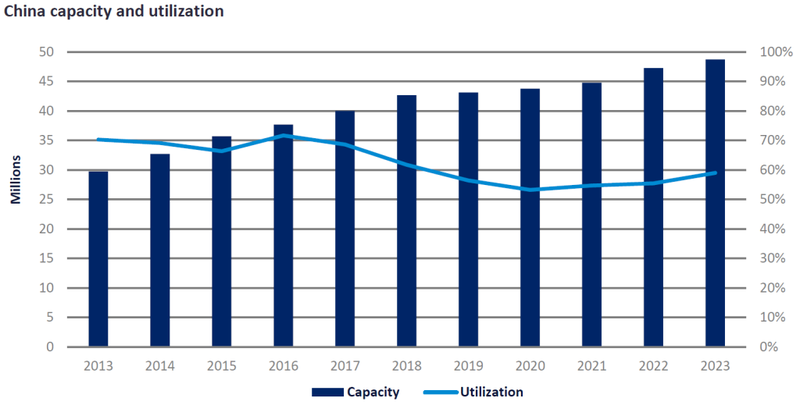

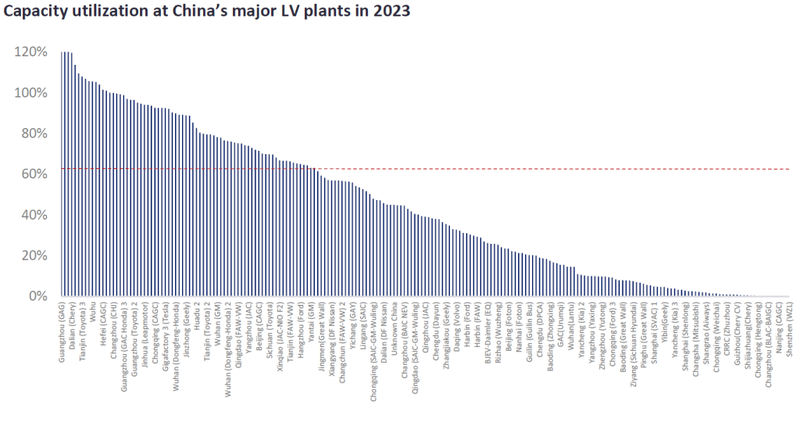

Against the background of the ebb and flow of ICE vehicle and NEV markets, the imbalance between production capacity and sales volume in the automotive industry has become increasingly prominent. In 2023, China’s LV production capacity will be 48.7 million units, with a capacity utilisation rate of 59%. The problem of overcapacity is becoming hard to ignore.

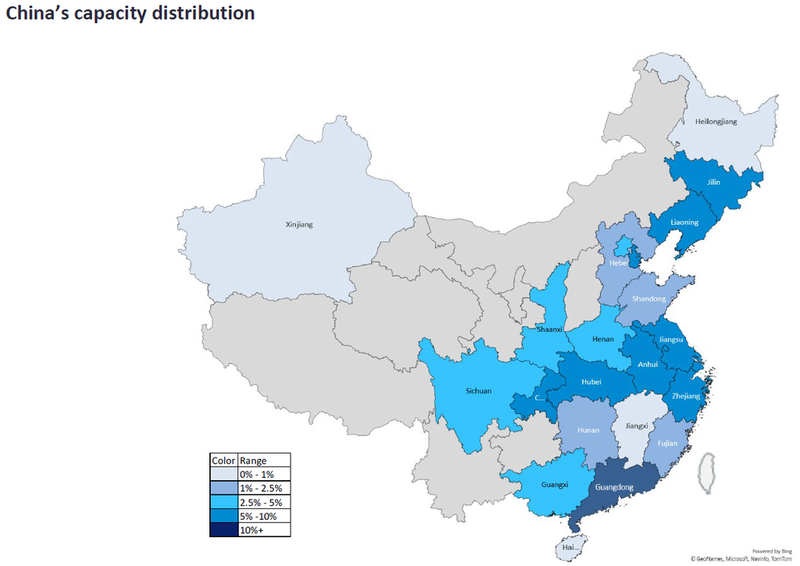

Overall, according to statistics, there are about 241 automobile manufacturers in China, of which about 20% are expected to produce less than 1,000 units in 2023, and about 17% of them are expected to produce less than 10,000 units annually. On the other hand, nearly 15% of factories will have a capacity utilisation rate of more than 95% in 2023, and their total output will account for 47% of 2023 total output. A considerable number of these enterprises have overcapacity problems. It can also be seen from China’s overall production capacity distribution that a large amount of production capacity is concentrated in coastal areas with developed economies.

A key factor driving this situation is the reshuffle of the automobile market. In recent years, China’s automobile industry has been accelerating its transformation towards electrification, intelligence, and connectivity. In future, the market penetration rate of NEVs will continue to expand, which also means that the capacity utilisation rate of ICE vehicle production will continue to decline. In 2023, JV brands have entered a state of decline. Among them, the production capacity utilisation rates of German, American and Korean brands have typically fallen below 50%. This situation has forced ICE vehicle plants to transform to electrification. For example, in June 2023, SAIC Volkswagen’s Anting Plant No. 1 announced its permanent closure. The plant had a planned annual production capacity of 160 thousand units and was mainly responsible for producing Sub-Compact cars such as Volkswagen’s Polo and T-Cross models plus Skoda’s Fabia. These once top-rated models in China have seen their market share fall fast due to the impact of NEVs. During this time, the Volkswagen Anting MEB plant started production in 2020 and is responsible for producing Volkswagen’s ID series models. Judging by the planned annual capacity of 300k units, it can be seen that Volkswagen is determined to transform from ICE to NEV.

Another factor is the polarisation and concentration of China’s automobile production capacity. With the transformation of the automobile industry and increasing investment in automobile industry projects, the scale of China’s automobile production capacity has also constantly expanded. However, the gap in capacity utilisation rates between different automobile companies is large. There has been a trend of high-sales volume groups having high production capacity utilisation rates, while low-sales volume OEMs have low production capacity utilisation rates. Regarding market share, in the first 10 months of 2023, the top ten sales groups totalled 16.02 million vehicles, accounting for 68% of the total sales volumes. Among them, BYD group’s capacity utilisation rate in 2023 is expected to be around 80%, while Tesla has reached 92%. In contrast, Hyundai Motor’s capacity utilisation rate will be only 23% in 2023, and Kia Motors’ capacity utilisation rate will be just 25%.

Against this background, Hyundai Automobile must put its Chongqing plant up for sale this year to maintain operations in China. This is the second time it has sold a factory after the sale of the Shunyi (Beijing) plant to Li Auto in 2021. It is foreseeable that after deep upheaval in the industry and the merger and reorganisation of automobile companies, the overall market concentration of China’s automobile industry among fewer players will keep increasing. This will be at the expense of older production capacity and to the benefit of optimisation of the overall industrial structure.

Therefore, given that China’s automobile industry continues to grow, China’s automobile production capacity structure will continue to adjust. On the one hand, resource allocation will be optimised through market mechanisms, and some backward and ineffective production capacities will be transformed, reorganised, or acquired and converted into plants which produce for other OEMs. For example, converting excess ICE vehicle production lines into NEV production lines is an effective way to transform excess legacy vehicle production capacity and revitalise production capacity resources. This is also a long-term process that those OEMs that have historic advantages in the field of ICE vehicles will implement in the future. For example, the second intelligent manufacturing centre of GAC Aion is based on the transformation of an ICE vehicle production line; NIO uses the production capacity of JAC after signing a joint manufacturing and production agreement with JAC and pays them more than CNY1.2 billion for the costs of production, achieving mutual benefit and a win-win outcome.

On the other hand, the state will appropriately use technology, environmental protection, and other means to regulate and guide the orderly exit of backward, low-end, and ineffective production capacity. Last year, the deputy director of the National Development and Reform Commission proposed that the automobile industry investment management regulations should be strictly implemented, the clean-up and rectification of illegal automobile projects should be strengthened, and the exit of backward enterprises and ineffective production capacity should be promoted. The approval of production qualifications of automobile companies will become more stringent in the future, and the country is inclined to optimise the layout of automobile production capacity and promote the healthy and orderly development of the entire industry.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.