Feature

South Korean battery makers review plans as BEV demand slows

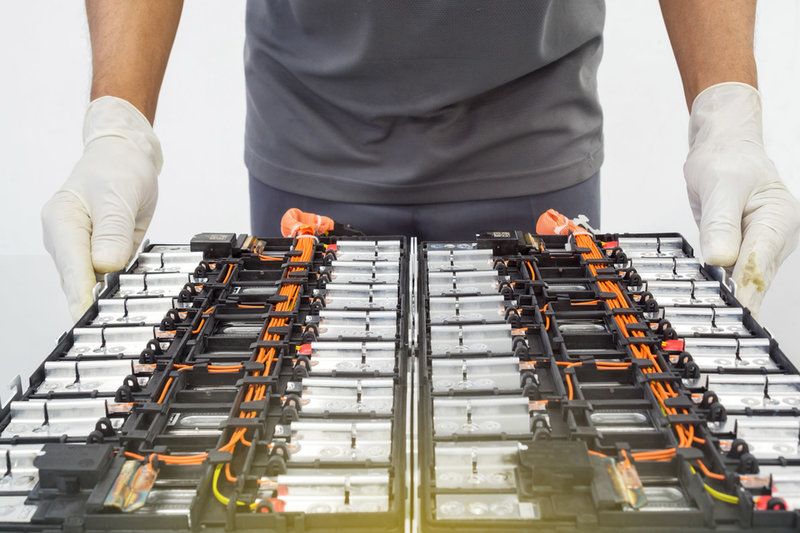

Slowing BEV sales growth in the US has led to overcapacity in the country’s battery sector and is set to increase significantly as more capacity comes on line.

Credit:

South Korea’s leading electric vehicle (EV) battery manufacturers are putting the brakes on their ambitious investment plans as growth in demand for battery electric vehicles (BEVs) in key markets around the world shows signs of slowing in the short-term.

While there is little doubt about the long-term global demand outlook for BEVs, with governments in the largest regional markets committed to transitioning entirely to zero-emission vehicles in the next 10-15 years, there is increasing concern that in the short-term growth may be slowing rapidly at a time when significant battery production capacity is scheduled to come on stream.

In North America, where South Korean battery manufacturers have been expanding most aggressively in the last two years, enthusiasm for BEVs looks to be waning as concerns over range, availability of recharging networks and even safety continue to weigh heavily on consumer choices, along with high prices and high interest rates. Comparatively low gasoline prices (compared with Europe) also act as a disincentive. A further slowdown in economic growth after last year’s Covid rebound and next year’s US presidential election have added another layer of uncertainty for the industry.

BEV sales are expected to account for around 9% of total passenger vehicle sales in the US this year, up from just over 7% in 2022. While sales are expected to exceed 1.1 million units, BEV uptake in the US is still way behind many markets in Europe and in China and is showing signs of slowing further. In September the average BEV sold by US dealers had been in stock for 80 days, compared with just 36 days a year earlier.

US automakers including Ford and General Motors recently announced they are scaling back their EV investments in the short term as a result of slowing demand growth, while Tesla also hinted at the possibility of slowing its “Giga” project in Mexico recently.

South Korea’s three leading EV battery manufacturers, LG Energy Solution Ltd (LGES), Samsung SDI Company and SK On Company, have been at the forefront of the US and European BEV battery industry expansion in the last two years. Individually they have investment plans worth many billions of dollars, including standalone plants and joint ventures with local vehicle manufacturers. Their aim is to collectively challenge China’s lead in the global EV battery segment, with the US and Europe the key regional markets providing their main growth opportunities. LGES, the largest of the three, last year said it aimed to overtake China’s CATL as the largest global EV battery manufacturer by 2030.

Slowing BEV sales growth in the US has already led to overcapacity in the country’s battery sector and this is set to increase significantly over the next two as more capacity comes on line. On a global basis, both LGES and SK On have reported falling capacity utilisation rates in recent months.

SK On, part of leading energy and chemicals conglomerate SK Group, is now reported to be reviewing its plans to build a second battery joint venture with Ford in the USA after the automaker said it would slow its US$12bn BEV investment programme. In November SK On also furloughed employees at its existing Jackson County plant in the US state of Georgia in response to falling demand. The company, which continues to lose money on its battery business, invested KRW4.8bn (US$3.7bn) on facilities expansion globally in just the first half of 2023.

LGES in November also announced it would lay off 170 workers at its battery plant in Michigan also in response to weak local demand. The company confirmed the layoffs are in response to “automakers realigning the speed of their BEV transition”. The company’s current investment plan as it stands would generate a battery production capacity of almost 300 GWhs per year in North America by the second half of the decade - enough to power some three million BEVs. This includes standalone plants and joint ventures with GM, Stellantis, Honda and Hyundai.

Outside the US, LGES recently confirmed that its proposed joint venture in Turkey with Ford Motor and local company Koc Holdings has been shelved amid concerns over demand. The plant was to have supplied mainly Ford’s Turkish assembly plant, which makes the Transit commercial van mainly for European markets. SK On was the original battery partner for this project, but pulled out of the project in January citing deteriorating funding conditions. Earlier this year LGES announced it was cutting output in Poland in respond to lower demand from Volkswagen.

The BEV market slowdown is also having a knock-on effect in battery materials supply chain, with South Korean battery materials suppliers including L&F Company, Korea Zinc, SK Nexilis and EcoPro BM also cutting their investments.

Lee Hang-koo, president of Jeonbuk Institute of Automotive Convergence Technology (JIAT) in South Korea, told local reporters: “The BEV market seems to be going through a correction. There is growing concern about overcapacity, as too much investment has been made in the sector in a short period of time”.

The cost of battery materials has dropped dramatically in just over a year, with the price of lithium carbonate down by over 70% from its peak just twelve months ago. This has helped vehicle manufacturers slash the prices of their BEVs, which along with ongoing technology improvements should ultimately help stimulate demand.