Research Snapshot: Taking the long view on hydrogen vehicles

Hydrogen is seen as a fuel of the future that is now coming down the tracks. We take a look at the state of automotive industry progress with hydrogen and fuel cells.

Cast your mind back a decade or so ago and you'll recall how hydrogen was among a number of promising alternative fuel candidates to replace petrol, compressed natural gas, bio-diesel and even battery-electric power. For a variety of reasons, however, demand for battery electric vehicles (BEVs) has gradually increased to the point where every carmaker is investing heavily in them.

A fuel cell electric vehicle (FCEV) uses a fuel cell instead of a battery or supercapacitor to power its on-board electric motor. Fuel cells in vehicles generate electricity to power the motor, typically using oxygen and compressed hydrogen. The interaction between the oxygen and hydrogen in a costly and complex metal box is called a fuel stack. Like BEVs, they are silent to drive and emit no harmful emissions. The only waste is water vapour.

FCEVs have some advantages over BEVs, including the time it takes to recharge and driving range. Unlike BEVs that take almost an hour to recharge to 80 per cent strength, hydrogen fuel cell cars can be refuelled and ready to go in less than five minutes.

The driving range of FCEVs is also said to be superior to BEVs although times are changing. While FCEVs can roam over 300 miles, some EVs are catching up. For example, the Tesla Model 3 Long Range has a 75kWh battery enabling a 'real-world' driving range of around 348 miles per charge, depending on your driving style and journey patterns. The Kia e-Niro can travel 282 miles on a single charge while the Hyundai Kona Electric with its a 64kWh battery, offers up to 278 miles (WLTP) on a single charge.

A few carmakers have offered hydrogen-powered cars to date, albeit leasing them in modest numbers. They include Toyota (Mirai sales to government and corporate customers began in Japan in late 2014) and Hyundai ix35 FCEV has also been available for lease since 2014.

Toyota, Hyundai are not the only carmakers investing in FCEVs. Earlier this year, SAIC Motor unveiled its first fuel cell-powered MPV in Shanghai, the Maxus EUNIQ 7, as part of a broader push to harness hydrogen as a key fuel of the future. The FCEV is fitted with SAIC's third-generation fuel cell system which the company said gives it a range of 375 miles and a hydrogen refuelling time of just a few minutes. The automaker said it was stepping up its spending in this segment and aimed to launch 10 FCEVs in the next five years to claim a 10 per cent share of sales in the country by 2025 with annual sales of around 30,000 vehicles. China plans to build over 1,000 hydrogen refilling stations by promoting annual sales of 1m FCEVs by 2030, according to a plan drawn up by the Ministry of Industry and Information Technology in 2016.

BMW used the 2019 IAA to unveil its i Hydrogen NEXT fuel cell development project. In a press release issued during the event, the carmaker stated: "The [concept] demonstrates that this technology can be integrated effectively into a dynamic vehicle like the X5 [due in 2022]."

Other carmakers taking an interest in hydrogen include the likes of Honda, Kia, Jaguar Land Rover (JLR) and Daimler. For its part, JLR is developing a prototype hydrogen fuel cell vehicle with its partners. Kia's research into fuel cells dates back to 1998, which resulted in the creation of the limited production Kia Mohave FCEV, able to travel up to 428 miles on a single fill-up.

Sustainable car company Riversimple is also exploring the application of hydrogen-powered vehicles. The Welsh start-up has developed a two-seater hydrogen fuel cell car known as Rasa (the name is derived from Tabula Rasa, which means 'clean slate' in Latin). Although it has yet to enter production, the company reports strong demand for its lightweight eco coupé.

While some carmakers continue to invest in developing prototype FCEVs, others are switching their R&D focus. The Volkswagen Group says it is focusing on battery-powered electric cars for the masses – even though Volkswagen Group Research is continuing to explore fuel cell technology and Audi, for example, has announced a small-scale hydrogen-powered vehicle for 2021.

Although FCEVs perform a clever chemical trick, they have some downsides. They are far more expensive than most cars with an ICE or, for that matter, battery-electric powered one. For example, a Toyota Mirai FCEV will set you back around £65,000 in the UK (available on a lease) whereas a Nissan Leaf will cost less than half that.

While driving a FCEV feels like a breeze, locating a hydrogen gas filling station is not plain sailing as there are very few refuelling stations dotted around the globe. In the US there are currently just 48 such stations, 42 of which are in California. So, you are free to roam around the state but must stay within reach of a station. In the UK, there are 15 places to refuel with hydrogen gas according to Zap Map.

The California Energy Commission (CEC) recently awarded Shell Hydrogen a US$40.8m subsidy to support hydrogen refuelling infrastructure in the state. Toyota and Honda - who have in the past cooperated on a hydrogen refuelling station adjacent to their respective campuses in Torrance (Toyota has since moved almost all operations to Texas) have agreed to expand FCEV sales in California in support of these hydrogen stations.

In supporting carmakers, component suppliers are also playing an important role in pushing back the technical boundaries. Faurecia Clean Mobility develops and produces novel solutions to drive mobility and industry toward zero emissions. Its R&D focus includes hydrogen fuel cell and battery packs. It is also investing significant resources in optimising the potential of hydrogen fuel-cell technology for the automotive sector.

The longer term play is hydrogen fuel cell systems.

During an interview with just-auto, Andrew Pontius, Vice President, Light-Vehicle Product Lines, North America, Faurecia Clean Mobility, said: "We believe very strongly in an electrified future, and in the near-term electrified means hybrids and some people who adopt BEV [Battery Electric Vehicles]. The BEV future will be shared between pure battery electric and range-extended battery electric with hydrogen fuel cell technology on board. … The longer-term play is the hydrogen fuel cell systems. At a minimum, we're already working on the hydrogen fuel cell tanks. So, this is a carbon fibre wound tubular tank that holds hydrogen at 700 bar, which is an incredible amount of pressure, which is why the cylindrical shape is so important to withstand that kind of pressure. The other part of the play is working on a smaller more energy-dense fuel cell stack where the hydrogen is converted into electricity. Those two things together constitute a huge percentage of the overall hydrogen fuel cell system."

Mahle said earlier this week that it is maintaining its investments in R&D at a high level and will further strengthen its activities by expanding its global competence centres, including those in Germany and China. It says key development areas are battery systems and hydrogen applications. The supplier recently began to install hydrogen testing infrastructure at its headquarters in Stuttgart.

Mahle CEO Jörg Stratmann advocates an approach that is open to all technologies. "Viewed from an international perspective, there will not be one single powertrain of the future," he says. "That's why Mahle is continuing to follow its dual strategy: electrification, development of the fuel cell, and the use of hydrogen and alternative fuels in an intelligently electrified combustion engine. At the moment, the change in powertrain technologies is driven primarily by political objectives. The current one-dimensional debate focused on a single drive is not productive. We want a dialog that has a basis in technology."

A lot of work has been done to reduce the amount of platinum in fuel cells, but the essential missing ingredient is the scale of manufacturing.

Paul Turner, Engineering Director at Revolve, a powertrain engineering services company says that cheaper fuel cells must be a prerequisite in the next generation of hydrogen FCEVs. During an interview with just-auto, he said: "A lot of work has been done to reduce the amount of platinum in fuel cells, but the essential missing ingredient is the scale of manufacturing, as they are not raw material dominated. It's all about making them it at the right price. If you look at batteries, you can see that the technology and its production is dominated by raw materials. People argue that battery prices will come down the more you make but typically the higher the demand for raw materials, the higher the price. If the technology has a materials bias then you will see costs increasing with volume, whereas if your costs are associated with the manufacturing process then, typically, your costs will come down."

While critics doubt whether hydrogen will ever be efficient or cost-effective for cars compared to other zero-emission technologies others believe that the next generation of FCEVs will be cheaper, more durable and reliable. The refuelling infrastructure certainly needs to expand while the cost of hydrogen stations – compared to BEV charging points – must fall. Fuel cell costs also need to tumble. And yet hydrogen has not completely lost out to lithium-ion. As and when the industry scales up then that situation could begin to reverse. But let's not get too hasty. Breakthroughs are never easy and take time. While hydrogen fuel cell vehicles are now unlikely to ever stand out as a mainstream alternative to ICE, the technology remains on carmakers' radar and will always find niche applications.

Cummins eyes hydrogen opportunity in heavy-duty

Cummins used its 2020 Hydrogen Day to set out ambitious plans to begin realigning its business towards fuel-cell-based products. Amy Davis, Cummins' VP and President of New Power noted that "over the past five years, we've built capabilities in battery electric and fuel cell electric powertrains. We are applying our deep expertise and relationships with customers to strategically plot their paths to delivery zero emissions vehicles".

Currently, the company is best known for its range of heavy-duty diesel engines that can be found in heavy trucks, buses, boats, trains and industrial power generation. However, tightening emissions regulations will make internal-combustion engines progressively more costly to run until they are ultimately outlawed over the next few decades. As a result, Cummins has invested in a range of hydrogen technologies.

While the passenger vehicle market is already switching to battery electric vehicles as the technology becomes viable and reaches cost parity with combustion-powered vehicles, the heavy duty and industrial market has proven resilient to the technology. This is due to the fact that such large batteries would be needed to power a heavy-duty truck, for example, that they would take up too much of its gross permitted vehicle weight, reducing its cargo capacity and, thus, making it less cost effective than diesel. In addition, long recharge times would add a lot of time to deliveries, eating into profit margins.

Conversely, hydrogen fuel cells do not come with the significant weight penalty that batteries do, and can be refuelled rapidly compared with the time needed to recharge a battery electric truck. This makes them a much more viable option for the heavy-duty truck and industrial markets, while also bringing direct exhaust emissions down to zero.

Having generated the hydrogen fuel, Cummins is also seeking to become a large-scale supplier of fuel cells to replace its range of diesel engines as the industry switches away from combustion.

Having generated the hydrogen fuel, Cummins is also seeking to become a large-scale supplier of fuel cells to replace its range of diesel engines as the industry switches away from combustion. To this end, Cummins acquired industry specialist Hydrogenics in September 2019 to enable it to develop a range of fuel-cell products for a number of applications.

Cummins expects that the first adopters of industrial hydrogen fuel cells will be train operators. Compared to heavy-duty trucks, train purchases represent a smaller incremental cost to the end user and, critically, run on fixed routes making it comparatively easy to install a refuelling system at either end of the track. Cummins expects that the cost of a hydrogen-powered train along with the necessary fuelling infrastructure to be lower than the cost of electrifying an entire line. In addition, train operators have access to public subsidies to soften the financial impact.

With this in mind, buses are likely to be the next target for Cummins' hydrogen systems. This is due to the fact that, like trains, their routes are highly regular and predictable, making the addition of hydrogen refuelling infrastructure comparatively simple. As prices for electrolyser installation and fuel-cell powertrains continues to fall, the technology will eventually become viable for trucking, which operates on flexible, variable routes.

Cummins already has 2,000 fuel cells already in service but is attempting to steal a march in the hydrogen field over its rivals some time before the technology is predicted to account for a meaningful share of the market. The Hydrogen Council estimates that, by 2030, hydrogen fuel cell penetration in heavy trucks will hit 2.5%, while penetration in trains and buses could be as high as 10%.

Supporting Cummins' existing investments is the joint venture it signed with NPROXX in late 2020 – a leading developer of high-pressure hydrogen storage tanks. The tanks developed are woven from fibres of carbon-fibre-reinforced polymer (CFRP) and can withstand pressures as high as 1,000 bar in some applications. By owning this complementary technology, Cummins is better able to develop an end-to-end hydrogen power solution for its customers.

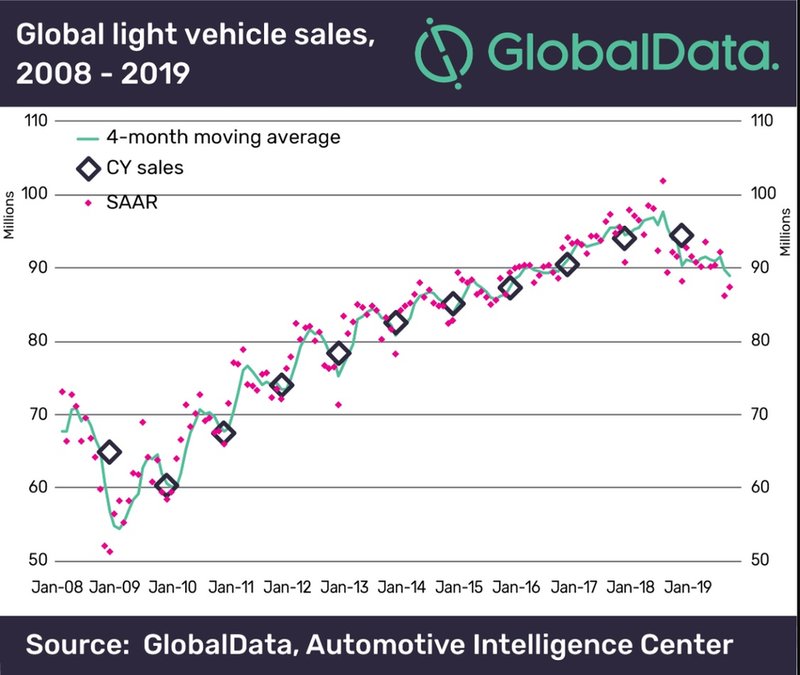

As far as 2020 is concerned much depends on prospects for the economy and measures that Beijing may introduce to stimulate demand.

Larger, curved screens

Jump into a new car today and you are almost sure to find a tablet-style touchscreen infotainment system positioned centre stage of the dash. It acknowledges that most of us no longer use maps to find our way around but expect the car to guide us to our destination and remain connected throughout the journey. For example, the Volvo XC90 comes loaded with semi-autonomous and connected car features, most of which are displayed on an intuitive centre console touchscreen.

As with most new technologies, what starts in the luxury market often trickles down the car segments. Inside the new Honda Civic, positioned at the top of the piano-black finish centre console - and drawing the eye as the push start is pressed - is a Honda Connect 2 seven-inch touchscreen, serving as the main point of contact to control the infotainment and climate control functions. This second-generation of Honda’s infotainment and connectivity system incorporates Apple CarPlay and Android Auto integration.

Tomorrow’s cockpits, according toHarman, will have more curved screens designed using OLED technology. The main advantage of an OLED display is that it works without a backlight, enabling it to blend into the interior.

Screens are becoming larger, too. The Tesla Model S features a huge 17-inch screen. But that is just the tip of the iceberg. China’s Byton has debuted its first concept car. A notable feature of the electric SUV is a colossal 49-inch screen stretching the width of the dash.

Whether or not such high-tech wizardry will actually make it onto the road, the above concepts demonstrate the direction the auto industry is taking.

Voice recognition

While giving instructions in our cars is nothing new, putting questions to the likes of Alexa and Cortana while on the road is. Automakers are fast adopting virtual assistants, confirming that speech is becoming the preferred interface for tomorrow’s cockpit.

Voice recognition is seen by some as the answer to eliminate many controls that have traditionally been manually operated. Voice can play an important part of a multimodal HMI solution for inputting information or for cutting through layers on the menus by requesting a function directly. Traditional voice control was centred on a set of fixed commands with catatonic responses which required some level of driver training prior to operation of the system. With the advent of the new low power, high performance microprocessors, smarter voice command engines linked into the HMI logic are now available. Even natural language and grammatical analysis are becoming more achievable.

Voice recognition, although already an option, looks set to play a bigger role as cars gradually become more autonomous.

If in doubt, ask: Microsoft’s Cortana AI system forms part of BMW’s Connected Car vision.

Gesture recognition

Looking down at a touchscreen (without haptic feedback) can be distracting. Gesture recognition is therefore said to be the Next Big Thing, regarded as the logical next step from touchscreens and buttons. Gesture control operates via a stereo camera within the cabin that can recognise certain hand movements for pre-programmed adjustments and functions. Rotating your finger clockwise at a screen could turn up the volume or a finger gesture could answer or decline a call. While such novelties will make life simpler for the driver, it should also simplify interior design and liberate space for storage options.

Interior lighting trends

Advances have also been made in the interior lighting department. Not so long ago, interior lighting consisted of central and side headliner lights, complemented by low-level ambient lighting located mainly in the cockpit area. Today, the accent has changed, thanks to widespread use of LEDs enabling personalisation of car interiors. For example, during night time driving, the Mercedes-Benz E-Class takes on an entirely different feel thanks to the ambient interior LED lighting that can be personalised using a palette of no fewer than 64 colours. It really does start to feel like a cockpit, adding illuminating highlights to the trim, the central display, the front stowage compartment on the centre console, handle recesses, door pockets, front and rear footwells, overhead control panel and mirror triangle.