FORECASTS

2022 and the global sales picture

After a bumpy ride in 2021, what can we expect in 2022 and where are the risks?

An emergency drill onboard AIDAsol cruise ship in 2019. Image: MikhailBerkut / Shutterstock.com

We’re in recovery from the worst of the pandemic and the economic havoc it wrought in 2020, but the recovery is not quite turning out to be as smooth as many predicted. The scale of the disruption to economies and industries, as well as the complexities for governments in dealing with an unprecedented public health crisis, have ensured that.

In the automotive sector, the rebound to overall sales and output as economies opened up again continued into 2021, until a number of bumps in the recovery path became evident and depressed vehicle markets – particularly in the second half of the year. A semiconductor shortage and subsequent supply-side impacts was compounded by the uneven progress – looked at globally – of vaccination strategies and the emergence of new Covid-19 variants that hit some regions (notably southeast Asia) more severely than others.

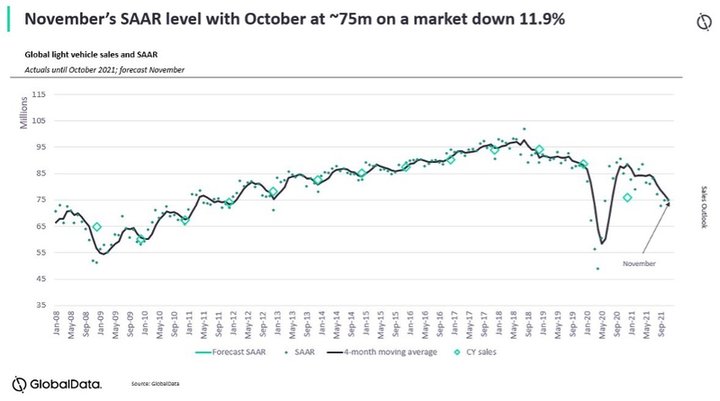

The chart below – showing the seasonally adjusted annualised rate of sales for the global light vehicle market – illustrates how the global market recovery petered out in 2021 after a sharp rebound in the second half of 2020.

At the time of writing, governments across the world are formulating strategies to deal with a new Covid-19 variant (Omicron) that has recently been identified and threatens to be more transmissible than its predecessors (Delta caused a new wave of infections and it looks like another wave from Omicron is arriving in time for the Northern Hemisphere winter). That could pose a big problem for health services and tighter restrictions on population movements – even in countries with a high degree of vaccination take-up – cannot be ruled out. It’s a big caveat to what follows in this article, a downside risk of uncertain magnitude. There’s a case for some upside risk if the Omicron variant’s real impacts are less serious than some initial reports have suggested. One lesson though, is that we’re not out of the pandemic and while we’re learning more on how to counter such a public health crisis through vaccinations, therapies and social controls, new variants or entirely new public health challenges could well be ahead.

All of that said, then, the outlook for 2022 is – broadly speaking – one of continued industry recovery, at least in terms of underlying demand. Forecasts for the global economy suggest it will cool down a bit in 2022, but still turn out to be well above average as economies continue to claw their way back to pre-pandemic levels of output. The IMF forecasts the global economy to grow by 5.9% in 2021 and 4.9% in 2022. Supply disruptions and the ongoing pandemic have caused the IMF to downgrade its outlook recently, but 2022’s 4.9% growth projection is significantly above a 3.3% annual growth level forecast beyond 2022 for the medium-term. Inflationary pressures are a concern, but price pressures are expected to subside through the course of the year, with interest rates staying low, central banks preferring a monetary policy stance that supports activity while the pandemic threatens the path of economic recovery.

Massive fiscal and monetary stimulus continues to stimulate demand in many countries – notably the US. Locked down populations have binged on goods, helping to drive shortages and supply-side problems. For those in work, savings have accumulated in the face of lower international recreational travel and hospitality spending. The global economy remains far from normal, distorted by the effects of the pandemic with consumer attitudes across the world in a fragile state.

Global automotive demand (and supply)

The auto industry is used to being demand-led, but supply-side issues will continue to shape the market in 2022 even as the situation eased through the course of the year.

The current lack of momentum in the global light vehicle market is expected to continue into H1 2022, but with build-back by OEMs mounting as we progress through the year and supply chain issues related to semiconductors ease. This is expected as automakers and major suppliers are finally able to benefit from internal actions such as structurally modifying electronic component requirements and product mix, combined with chip sector manufacturing capacity enhancements.

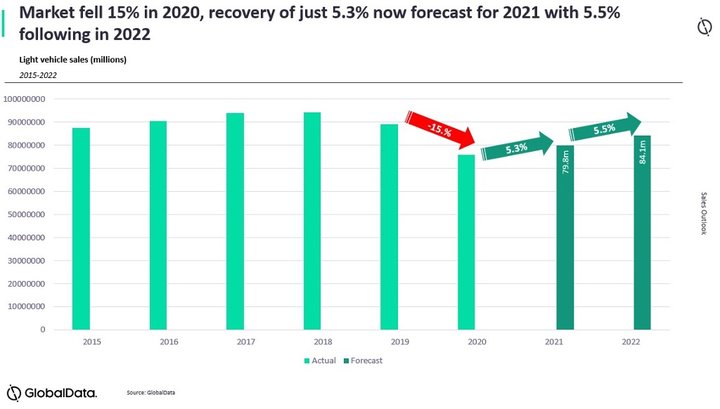

GlobalData forecasts that the global light vehicle market in 2021 will total 79.9 million units, just 5.5% ahead of 2020 (75.7 million), with the chips crisis and resultant supply shortages this year contributing to a market around 4 million units below where underlying demand suggests it should have been. For context, the global light vehicle market exceeded 90 million units during the 2016-2018 period (slowing slightly in 2019).

The outlook for 2022 is for the global light vehicle market to grow to around 84 million, but supply and demand issues – as well as ongoing pandemic risks – point to a continuing fragility to the auto industry’s recovery next year. At 84 million units we’re still not quite back to pre-pandemic levels, though.

And there are risks (besides the pandemic factors mentioned above and any associated downturn to consumer and business confidence) to even this moderate uplift. Pressures from energy costs and inflationary sources are rising and will hit businesses and households in the first half. This could bring a slowing in demand even before chip supply is realigned. On the flip side, fiscal stimulus is still abundant in many economies and personal mobility needs are high.

SAAR rates in first half of the year likely to remain subdued because of supply shortages, but if macroeconomic headwinds are light, the second half of the year should bring a stronger market. However, overall volume is destined to remain below pre-pandemic levels until at least 2023. By then, industry’s thoughts and concerns may return to worries over the rising share of ride-hail operators in mobility in urban and suburban areas. On that point, much will depend on how comfortable people are to share rides and whether or not the pandemic has permanently shifted attitudes.

There has been an interesting disconnect between lower-than-expected vehicle markets and automotive firms still able to post healthy profits in 2021. The smarter ones have adjusted their sales mix to take account of limited chips supply. It is not just the natural high-margin premium brands either – Ford and GM have enjoyed sales of high margin pickups and other trucks. Industry sentiment – something GlobalData tracks on a number of metrics – has been pretty robust. Indeed, looking at performance and pandemic impacts, automotive is seen as an industry in a relatively strong position compared with others.

The resilience of positive sentiment regarding autos is probably down to a combination of factors such as M&A activity and electric vehicle hype. The latter has been especially significant, led by omnipresent headlines involving Tesla and talisman Elon Musk. When he embarked on the Tesla project, his stated ambition was to lift demand for electric cars generally in the interest of environmentally positive goals. To achieve that, he wanted to introduce desirable electric car products and bring the industry with him. With Tesla sales around the world growing strongly and new manufacturing capacity coming on stream (in Shanghai and, in 2022, in Berlin) he has achieved considerable success.

Electric car sales will be a growth pole for the industry and momentum will continue in 2022, with significant new electric product coming to market (such as, for example, the Renault Megane E-Tech, VW ID.5, Cupra Born, BMW iX).

Momentum towards EVs now established – production to increase rapidly

GlobalData figures show that battery electric vehicles accounted for around 3.0% of all new light vehicle production in 2020, up from 2.3% in 2019 and a noticeable leap from 0.7% in 2016. By 2025, GlobalData expects global electric vehicle production to rise four-fold to more than 11.6 million units, accounting for 11.6% of global light vehicle sales by volume. By 2031, global electric vehicle production should hit 28 million units, accounting for 26% of the total light vehicle market.

In 2022, GlobalData forecasts world electric light vehicle production of 5.9 million units (versus an estimated 4.3 million in 2021).

By 2036, GlobalData forecasts global electric vehicle production of 45.0 million units, accounting for around 40% of total light vehicle production. So, while the direction of travel on EVs is clear, ICEs and hybrids have a role to play for some years yet.

Major regional issues

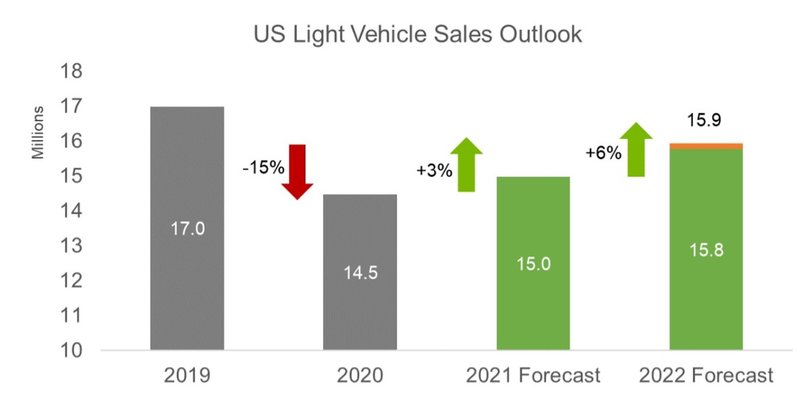

In the US, the rate of light vehicle market decline (at -16%) eased in November, but inventories remain tight – though there are signs of some easing of the chips crisis. Retail sales were below the 1 million threshold for the fourth consecutive month and fell to their lowest level so far this year, at an estimated 850,000 units. However, industry data shows that average transaction prices continue to break records and were above US$40,000 for the sixth consecutive month, adding additional risk to demand.

Analysts at LMC also said the pace of plant shutdowns in North America has slowed from previous months and it has reduced its expected production loss in Q4, due to chip shortages and other disruptions, by 100,000. However, it also said vehicle manufacturers are choosing to slow the daily build rate instead of shutting down the entire plant, reducing the visibility of output downtime. With the slight improvement, the 2021 production forecast remains at 12.9 million units, 6,000 units lower than 2020.

With some additional stability in production, the outlook for US auto sales has improved slightly for 2022, LMC said – from 15.7 million units to 15.9 million units, an increase of 6% over 2021. The improvement is expected to be more pronounced on the fleet side of the business, which is expected to recover to 15% of total Light Vehicle sales. Retail sales are also expected to improve next year but by just 4%.

LMC estimates that the US market in 2021 lost around 2.4 million units due to the semiconductor shortage.

In the US, some risk to the outlook derives from worries over the course of price inflation and whether or not the Federal Reserve Bank will decide to raise interest rates.

China’s vehicle market has been constrained by the chips crisis in 2021, but is on course for 25 million units in 2021 – slightly up on 2020. Some uptick is forecast for 2022, but the overall prognosis is for muted growth in 2022 – a market projected at around 26.5 million. China’s rate of economic growth has moved below trend, hit by supply-side bottlenecks across all industries. Further, concerns over the potential impact of new and more transmissible Covid-19 variants (such as Omicron) are especially acute in a country that has pursued a ‘Zero Covid’ strategy backed up by draconian population movement control measures.

Economic growth in China has slowed significantly in recent months due to weakening consumer confidence, reflecting major solvency issues in the country’s property sector, while supply chain bottlenecks and power shortages have also held back factory output.

There are also mounting concerns over China’s economic management and financial sector risks, especially concerning high levels of indebtedness in China’s economy built on real estate (typified by Evergrande’s $300bn debt). China’s real estate market is slowing and Chinese regulators have lately cracked down on excessive borrowing by developers. Lower asset prices and an overhang of supply, combined with an already lower level of economic growth in 2022 means that stresses could be felt across the banking sector in China, with broader fallout across the economy – which would hit vehicle demand. It’s a risk.

As ever though, expect Beijing to act quickly with stimulus measures if economic growth is seen to be too sluggish. In that eventuality, the automotive sector is usually an early beneficiary, sales and production sensitive to tax breaks.

Electric vehicles are where the action is in China’s automotive market and industry. The Chinese market for new energy vehicles (NEVs), comprising mainly electric and plug-in hybrid vehicles, is set to more than double in size to over 3 million units in 2021 from 1.37 million units in 2020, according to the China Association of Automobile Manufacturers.

The NEV segment has vastly outperformed the overall vehicle market so far this year, with sales rising by 185% to 2,157,000 in the January-September period while sales of conventional internal combustion engine (ICE) vehicles were just marginally higher at 16.4 million units.

Growth has been driven by the battery powered EV segment, which expanded by over 200% to 1,788,000 units in the nine month period, while sales of plug in hybrids were up by 138% at 367,000 units.

Chinese startups – like NIO and Xpeng – but also established companies like SAIC (through the MG brand) are now targeting export markets, especially Europe, with competitively priced electric cars. The big advantage for Chinese companies is that they have a huge domestic market base to lever for scale and lower unit costs. That can be especially significant in electric vehicles.

The SAIC-GM-Wuling Hong Guang baby electric car (at an estimated purchase price of around $4,500) has been very successful in China’s domestic market and is being prepared for export to Europe. Electric startups NIO and Xpeng are also eyeing European exports. On the flip side, Tesla has become a top selling brand in China’s high‐end EV sub-segment now that its Shanghai plant has ramped up to full capacity (and it is now exporting in significant numbers).

In Europe, attention is firmly focused on the path of the pandemic and the impact of variable infection and vaccination rates across countries, but the regional economy is performing relatively strongly, supported by a tight labour market and robust consumer spending. Demand-side issues have been eclipsed by supply-side problems over the past year, markets constrained well below where they should be – a trend that worsened in the autumn months, with the Big Five light vehicle markets down almost 30% in October. GlobalData forecasts the total West European light vehicle market at 12.37 million units for 2021, a near 1% decline on 2020’s pandemic ravaged level. The first half of 2022 is likely to see concerns over chip supply as well as inflation (especially via higher energy prices) keeping the vehicle market generally subdued in the first half. The second half of the year should see demand accelerate and some ‘rebound’ sentiment as consumer and business confidence picks up – if the public health crisis and macroeconomic background allows.