DEALS ANALYSIS

Deal activity trends down in most regions; Europe is top region by deals value so far this year

Powered by

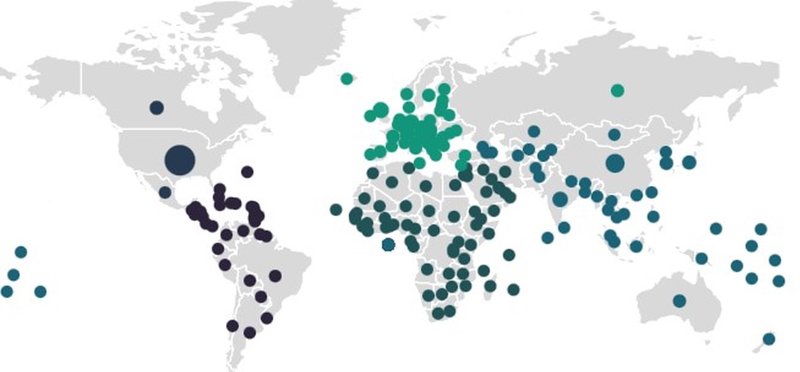

Deals activity by geography

Deals activity, as tracked and measured in GlobalData’s deals database, is down this year – measured by both value and the volume of deals.

So far this year, North America leads on the volume of deals in the automotive sector, Europe leads on value. Deals volume decline is lowest in Asia-Pacific.

Volatile market conditions and uncertain prospect across much of South and Central America explain lower deals activity there.

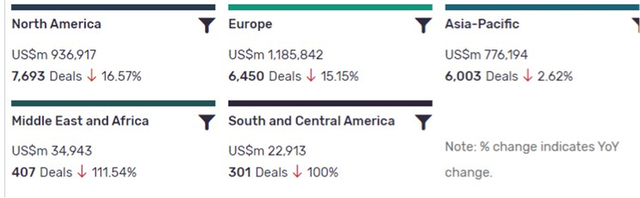

Deals activity by theme

Deals activity in automotive grouped by major thematic categories shows that activity is centred in areas of advanced and emerging technologies that are especially relevant to this vertical – especially batteries (electric vehicles) and the Internet of Things (connectivity which includes in-car e-commerce). There are also strong showings for AI, robotics and digitalization – technological themes that will be shaping the long-term outlook for the industry’s participant companies. Much of this activity has been in the supplier area of the industrial supply chain, but this year is seeing a strong showing for vehicle manufacturing and ‘future mobility’.

Deals by sector

Note: All numbers as of 14 December 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Automotive Intelligence Center

Latest deals in brief

Faurecia public takeover of Hella confirmed

Faurecia will hold 79.5% of Hella after completing the acquisition, expected to be completed in early 2022.

Stellantis takes full control of Malaysian assembler

Stellantis has acquired full control of its Malaysian vehicle assembler Naza Automotive Manufacturing. Through PSA Group, Stellantis already had 56% of the equity in Naza with the local group controlling the remainder.

Vitseco debuts on Frankfurt stock market

Continental spin-off Vitesco had its IPO in Frankfurt in September. It says it will re-focus its business to the electrification needs of its OEM customers. Vitesco, which produces powertrain components for internal combustion engines, hybrids and electric cars, issued 40 million shares.

Intel intends to take Mobileye public in US

Intel says it intends to take Mobileye public in the US in mid-2022, via an initial public offering of newly issued Mobileye stock. The move will create a separate, publicly traded company and will build on Mobileye’s track record and serve its expanded market. Intel will remain the majority owner of Mobileye and the two companies will continue as partners, collaborating on projects as they pursue the growth of computing in the automotive sector.

BP takes slice of battery swap JV in China

UK energy group BP has signed an agreement to acquire a stake in Guangzhou Aulton New Energy Technology to expand its involvement in the Chinese battery swapping market. Guangzhou Aulton New Energy, a subsidiary of Aulton New Energy Automotive Technology, will operate as a joint venture with BP providing “safe and efficient battery swapping services” for taxis, ride hailing companies and private battery powered vehicles in Guangzhou.

GM acquires 25% stake in e-boat firm

General Motors has acquired a 25 percent ownership stake in Pure Watercraft, a Seattle-based company that specializes in creating all-electric boating solutions. GM is diversifying its tech interests to utilize its technology beyond automotive applications.

BASF to spin off catalysts unit

BASF has said it plans to carve out its mobile emissions catalysts business and spend up to EUR4.5bn on battery materials and recycling. The stand-alone mobile emissions catalysts and associated precious metal services entity will be based in Iselin, New Jersey.