STRATEGY

How does the growing US EV market stack up against other major EV regions?

The US light vehicle market faced another challenging year in 2022, but the EV space showed resilience in pursuit of aggressive sales targets. Matt Lucki writes

The US light vehicle market faced another challenging year in 2022 hampered by inflation concerns, rising interest rates from the Fed, and continuous supply chain shortages across the industry. The electric vehicle space showed resilience as automakers rolled out their electrification strategies in pursuit of aggressive BEV sales targets.

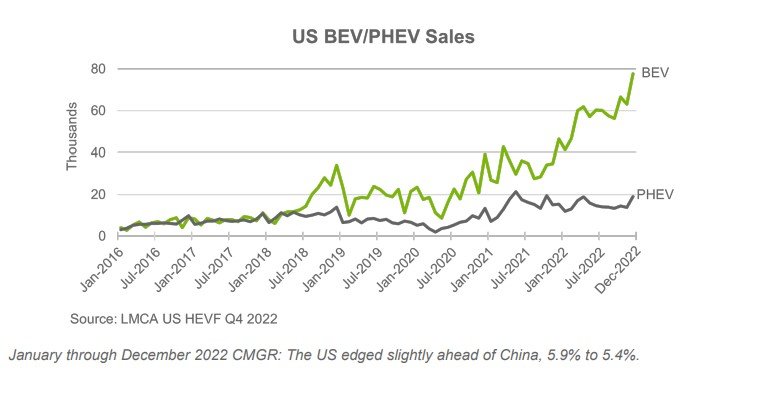

Tesla initiated US BEV growth by launching its more affordable Model 3 in late 2017 starting the upward trend that put automakers on notice. The BEV market closed 2022 with a 76% year-on-year growth rate and exceeded a 5% market share, nearly doubling the prior year’s share of 2.7%. The end-of-the-year sales push carried December 2022 to a new 77,600-unit sales record as legacy OEMs worked in unison to release competitive models to end Tesla’s dominance.

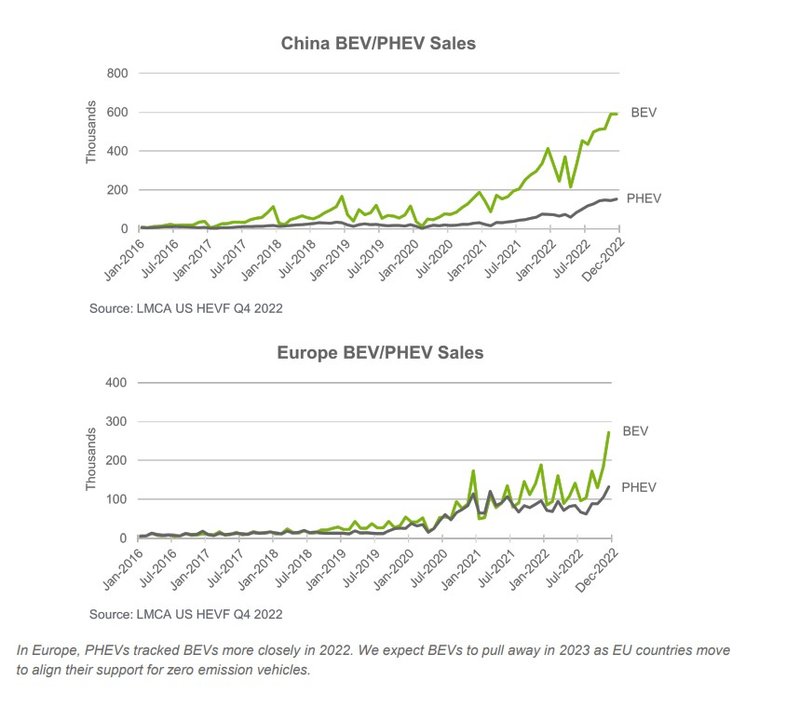

From a volume standpoint, the impressive gains in the US pale in comparison to the other major BEV markets. China averaged 420,000 BEV sales per month in 2022 and Europe averaged nearly 140,000. This should not come as a surprise given China’s automotive market is twice the size of the US and, along with Europe, pushed electrification early by imposing strict government mandates and emission targets. However, while the US lags the other regions in terms of infrastructure and enforced government regulation, it is worth noting that the US growth trajectory follows China with BEV sales now pulling away from other plug-ins.

The 2 is Polestar's sole model but the 3, 4, 5 and 6 are on the way

The 2 is Polestar's sole model but the 3, 4, 5 and 6 are on the way

2023 onward

Electric vehicles face headwinds into the new year as the revised US federal tax credits take effect. Buyers will be disenchanted to learn most, if not all, of the US$7,500 credit no longer applies, specifically in the case of imported models. The Inflation Reduction Act (IRA) brings a new sense of urgency for automakers to localise BEV assembly and battery material production, which likely increases future vehicle costs. In the near term, expect OEMs to slash prices to offset lost credits. Meanwhile, traditional high-trim ICE vehicles will bolster profits until batteries begin reaching price parity with combustion engines.

Main image: