Powered by

GlobalData Executive Briefings

Understand the COVID-19 outbreak and its impact on the global economy via free-to-download GlobalData report: COVID-19 Executive Briefing.

Also, Ukraine Conflict: Executive Briefing(free-to-download). A comprehensive overview of the Russia-Ukraine conflict for those wishing to develop their understanding of its effect on business fundamentals.

Download Covid-19 Executive Briefing

- ECONOMIC IMPACT -

Latest update: 17 March

Worldwide GDP forecast looks positive. After downturn for several months, positive GDP is forecast in all countries; 2021 consensus forecast for GDP growth is currently 5.6%.

Unemployment continues to be high. According to the OECD, the unemployment rate in OECD nations stood at 6.8% in December 2020.

- SECTOR IMPACT-

Latest update: 14 June 2022

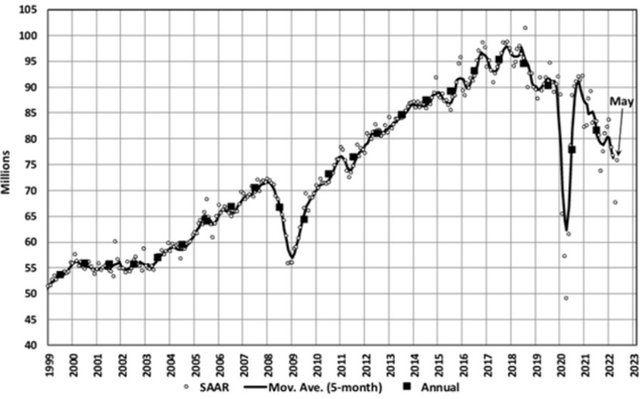

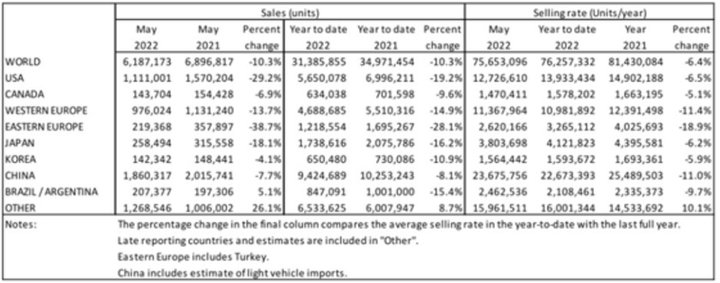

The Global Light Vehicle (LV) selling rate improved to 76 million units/year for May 2022, following a very poor result in April. Supply bottlenecks remain the key issue for the global automotive industry, with manufacturers unable to meet demand in most regions. In year-on-year (YoY) terms, sales were down 10%. In China, the reopening of manufacturing facilities in mid-April supported a strong rebound in sales. In the US, the industry is struggling in the face of record high transaction prices, low inventory, and low incentives.

North America

US Light Vehicle sales fell by 29.2% YoY in May, with the annual comparison being hurt by two fewer selling days than in May 2021, and a high base effect. That said, it was still a poor result, as Memorial Day failed to provide a boost to the market, which is still being impacted by low inventory. The selling rate slowed to 12.7 million units/year, from 14.5 million units/year in April. Average transaction prices hit a record US$45,502, while incentives dipped below US$1,000 for the first time in recent history, at US$950. May average monthly payments also reached a new record – at US$670, they increased by US$100 YoY.

Canadian LV sales are estimated to have decreased by 6.9% YoY in May, to 144k units. The selling rate likely picked up marginally to 1.47 million units/year, from 1.46 million units/year in April, but this is the first time in two years that the rate failed to reach 1.5 million units/year for two consecutive months. The market remains sluggish, largely due to tight inventories. On the other hand, Mexican sales grew by 6.3% YoY in May, to 91k units. The selling rate accelerated to 1.18 million units/year, the highest since February 2020

Europe

The West European selling rate increased to 11.4 million units/year in May but remained on a weak footing. While the demand environment this year has become increasingly challenging, as consumer confidence has made a step-change down since the start of the war in Ukraine, it remains the supply side of the automotive industry that holds back better registration statistics.

The East European selling rate was 2.6 million units/year in May. The region’s largest market, Russia, saw a selling rate of just 289k units/year, which was a fraction of the levels recorded before the war in Ukraine. A rebound in sales is not anticipated in the short-term mainly due to severe supply constraints.

China

According to advance data, the Chinese market rebounded strongly in May after a sharp slowdown in April. The May selling rate reached 23.7 million units/year, up 66% from April. In YoY terms, however, sales (i.e., wholesales) contracted by 7.7% in May and 8% YTD. Looking more closely, the selling rate of Passenger Vehicles (PV) in May (21.5 million units/year) was higher than those of both February and March. PV sales declined by only 1.3% YoY in May, while sales of Light Commercial Vehicles (LCVs) fell by 40% YoY, indicating that the recovery was led mostly by PVs.

Such a strong rebound in sales reflects a fast recovery in production (which resumed in mid-April, prior to the lifting of the major lockdowns on 1 June). In May, PV production increased by 5% YoY, as OEMs ramped up manufacturing to meet pent-up demand. NEVs continued to lead the market, with their sales expanding by 116% to 440k units in May.

Other Asia

The Japanese market remains volatile, due to the fluid supply situation. The May selling rate was 3.8 million units/year, down nearly 15% from April, bringing down the YTD selling rate to 4.1 million units/year. In YoY terms, sales declined by 18% in May (the 11th consecutive month of contraction) and 16% YTD. Due to China’s lockdowns, the shortages of components intensified, causing supply constraints. In addition, sales were disrupted by the week-long national holiday.

In Korea, sales remained sluggish in May, despite the fact that production increased. As the Korean OEMs continued to prioritize the export market to take advantage of the weak won, the supply of new vehicles for the domestic market remained in severe shortage. The May selling rate was 1.56 million units/year, the third straight month of slowdown. In YoY terms, sales contracted by 4% in May and 11% YTD.

South America

Brazilian LV sales fell by 0.7% YoY in May, to 175k units. The result was by far the largest in the year – beating April by 38k units – and caused the selling rate to accelerate to 2.07 million units/year. This was the strongest selling rate since December 2021. Availability appeared to improve for a number of popular models in May, enabling large MoM increases. However, perhaps in part because of the more robust sales, inventory overall actually decreased MoM in May, to 123.9k units, from 128.9k units at the end of April.

In Argentina, LV sales grew by 53.4% YoY in May, but that result was largely due to a low base effect, as sales in May 2021 were impacted by COVID-19 restrictions. Compared to the last month of May that could be considered normal, in 2019, sales were down by 5.8%. The selling rate increased to 388k units/year in May 2022, up from 362k units/year MoM. Last month’s rate was the highest since June 2021, but the overall picture remains one of tight supply and concerns over high inflation and rising interest rates.

Covid-19 briefing