Europe’s diesel car market in inexorable decline

Europe’s diesel car market has been in seemingly inexorable decline in recent years. Al Bedwell crunches the data and considers the outlook.

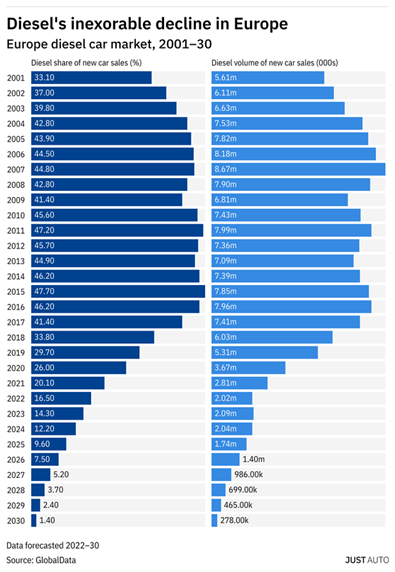

In share terms, Europe’s diesel car market peaked in 2015 at 48%, thirty years after it first achieved double digit penetration of the pan-Europe car market. But within a decade of the peak, it will have fallen back below a 10% mix of the region’s passenger vehicle fuel type spectrum. By the end of this decade, it will have disappeared altogether from many markets with share across the region likely to be well below 5%. At its most prolific, diesel car sales were not far off nine million units (in 2007) and were in excess of seven million consistently from 2004 to 2017.

We tend to think of VW’s dieselgate incident in 2015 as the start of the decline of diesel but in fact the seeds of its demise were planted before that time. There was growing concern that diesel’s CO2 advantage over gasoline meant that it was being given excess leeway as regards regulation of its noxious emissions (primarily NOx and PM) compared with the tougher standards that gasoline cars had to meet. Making diesel achieve similar levels was possible (and has been achieved with the latest diesel cars) but it was expensive and hence slow to evolve. At the same time, the type of technology that made diesel efficient was migrating to the gasoline sector resulting in torquier gasoline engines with efficiency that may not match diesel (all things considered) but wasn’t far behind. Governments then started to disfavour diesel cars by way of penal taxation which eroded savings from better fuel efficiency and cheaper (in many markets) fuel versus gasoline fuel.

Of course, VW’s diesel image destroying activity was a catalyst for acceleration of diesel decline but as noxious emissions targets in Europe (Euro 5, Euro 6…) became tougher the cost of diesel emissions compliance widened the price gap between diesel and gasoline cars and made diesel uneconomical in firstly small and then increasingly in medium sized car segments.

The advent of large-scale electrification has further hastened the move from diesel (with gasoline eventually suffering the same fate). Electrifying diesel adds to its cost and while fuel efficiency will improve, the industry recognised some years ago that to pursue strong diesel electrification would be throwing good money after bad. Diesel engine development has all but ceased in Europe now, with only those Euro 6 engines that were developed from the outset to be able to meet Euro 7 standards likely to survive much beyond mid-decade, and then only in larger vehicles where diesel is still a winner, particularly for extended high speed driving.

Diesel technology has been developed from agricultural levels of refinement into a powerful, frugal, and clean state and in many ways it is a shame that it will die in the PV (and eventually in the LCV) segment, but there is now no way back for it.

Main Image: TraceSafe contact tracing technology is being used to help the cruise industry. Credit: TraceSafe

DIESEL’S DECLINE